THE AMERICAN EXPRESS PLATINUM CARD

i

American Express® Platinum Card

Insurance

Terms and Conditions

Eective 15th March 2022

American Express Australia Limited ABN 92 108 952 085. ® Registered Trademark of American Express Company.

ii

THE AMERICAN EXPRESS PLATINUM CARD

Contents

Terms And Conditions 1

• About this Policy 1

• Cancelled or Suspended Cards 1

• Termination 1

• Remember To Check This Policy 1

• Always Take Care When Travelling 1

• Making A Claim 1

• Changes To This Policy 1

Important Things To Know About This Policy 1

• Excess 1

• Pre-Existing Medical Conditions 3

• Pregnancy & Travel Insurance Benets 3

• Exclusions Within This Policy 4

• Age Limits 4

• Excluded Sports And Activities 5

• COVID-19 5

• Travelling Against Medical or Government Advice 5

• Return Trips Only 5

• Loss Damage Waiver Cover for Rental Vehicles 5

• Fraud 6

• Australian Law 6

• Australian Currency 6

Chubb Assistance (In The Event Of An Emergency) 6

Eligibility For Cover Under This Policy 6

• Eligibility Table 7

If You change Your American Express Card Account

product, or Your American Express Card Account is

Cancelled or Suspended 9

Coverage Summary 11

Schedule of Benets 16

Denitions 20

Benets 24

• Section (A) Trip Cancellation And Amendment Cover 24

• Section (B) Card Account Balance Waiver Cover 27

• Section (C) Personal Accident Cover 27

• Section (D) Travel Inconvenience Cover 28

• Section (E) Medical Emergency Expenses Cover 29

• Section (F) Resumption Of Long International Trip Cover 30

• Section (G) Personal Baggage, Valuables, Money

And Travel Documents Cover 31

• Section (H) Personal Liability Cover 34

• Section (I) Loss of Income Cover 35

• Section (J) Hijack Cover 35

• Section (K) Kidnap Cover 36

• Section (L) Loss Damage Waiver Cover 36

• Section (M) Card Purchase Cover 37

• Section (N) Card Refund Cover 38

• Section (O) Buyer’s Advantage Cover 38

• Section (P) Smartphone Screen Cover 39

• General Exclusions Applicable To Sections A–P above 40

• General Conditions Applicable To All Sections 41

Assistance Services 42

• Section (Q) Legal Assistance 42

• Section (R) Roadside Assistance 42

• Section (S) Home Assistance 43

• General Terms And Conditions Applicable To Assistance

Services, Sections Q–S Above 44

How To Make A Claim 44

General Information About This Policy 45

Privacy Statement 46

• Why We collect Your Personal Information 46

• How We obtain Your Personal Information 46

• When do We disclose Your Personal Information? 46

• Exchanging Personal Information with American Express 46

• Your decision to provide Your Personal Information 46

• Access to and correction of Your Personal Information 46

• How to Make a Complaint 46

Complaints And Dispute Resolution Process 47

Financial Claims Scheme 47

General Insurance Code Of Practice 48

Sanctions 48

THE AMERICAN EXPRESS PLATINUM CARD

1

Terms And Conditions

This Policy is eective from 15/03/2022

American Express® Card Insurance Policy Number: 09NACPLT06

Eligible American Express Card Products

This Policy applies to the following American Express Card Account

product only:

(a) American Express Platinum Card.

About this Policy

This Policy sets out important information about the insurance benets

available to Card Members, Additional Card Members, their Spouses

and Dependent Children. It explains the nature of the arrangements and

relevant benets and risks. If You feel that this product does not meet Your

specic needs and intended coverage, this Policy may not be right for You.

You may need to buy separate or additional insurance if this Policy does

not cover You for all the things You need cover for.

This document provides general advice only. It does not take into account

Your individual objectives, nancial situation or needs. You need to decide if

the limits, type and level of cover are appropriate for You.

There is no obligation to accept any of the benets of this Policy. However,

if You wish to make a claim under the cover provided within this Policy,

You will be bound by the denitions, terms and conditions, exclusions and

claims procedures set out in this document.

This Policy oers 3 main types of benet and services:

1. Travel insurance benets

2. Retail item cover

3. Personal assistance services.

Cancelled or Suspended Cards

If your card is cancelled or suspended, you are not entitled to cover under

this Policy. It is your responsibility to make sure that your minimum

repayments are paid on time and that you comply with your American

Express Card Account terms and conditions. Refer to Your American

Express Card Account terms and conditions or please contact American

Express by calling the number on the back of your Card to obtain a copy.

Termination

Cover will be terminated at the earlier of the following:

• Your American Express Card Account is cancelled or suspended; or

• termination of the Group Policy.

Upon termination of the Group Policy, the insurance benets will no longer

be available to Card Members after the termination date. If You have

satised the eligibility criteria prior to the termination of the Group Policy,

cover is still available with respect to the cover section(s) that You are

eligible for. American Express will always notify You in advance if the Group

Policy is to be terminated.

Remember To Check This Policy

It is important to check this Policy from time to time, particularly before

You travel to remind yourself of what is and isn’t covered. Some things

You might consider doing whilst travelling might not be covered (for

example, jet skiing, bungee jumping or hiring a scooter if You don’t have a

motorcycle licence).

You may need to buy separate or additional insurance if this Policy does

not cover You or the things You need cover for.

Please familiarise yourself with this Policy. We want to ensure You are clear

about what it covers and what it does not cover or excludes. If You are

unclear about anything in this document, please call 1800 236 023 and

Our insurance team will be happy to assist You with any enquiries.

Always Take Care When Travelling

Make sure You have checked the most up to date Australian Government

travel advice before You go on a Trip to understand any specic risks for

Your destination. You also need to make sure You take care with Your

belongings, make sure You keep valuable possessions on You and never

leave Your luggage Unattended (for example, in a car overnight). This

insurance is not designed to cover carelessness or high-risk activities, so

be a sensible and prudent traveller.

Making A Claim

If You need to make a claim, keep supporting documents and proof of

any loss, including all police reports, sales receipts and card statements

showing any purchases made. See Section ‘How To Make A Claim’ for

more detail.

Changes To This Policy

The cover under this Policy may be updated from time to time. A copy of

the current policy wording can always be found by visiting the American

Express Australia website at: https://www.americanexpress.com/au/

insurance/insurance-with-your-card/. This document replaces and

supersedes any Policy issued prior to the eective date.

Important Things To Know About This Policy

We have listed a number of important things (below) that You should know

about this Policy. This information is not intended to be a complete list of

all coverage sections, terms, conditions or exclusions under this Policy.

Rather, the information is intended as a quick reference point to assist You

in Your understanding of this Policy.

Excess

Where applicable, an Excess is applied for each Event.

If a claim is covered, the Excess is rst deducted from the amount We will

pay and before any relevant depreciation and limits have been applied to

the claim amount.

2

THE AMERICAN EXPRESS PLATINUM CARD

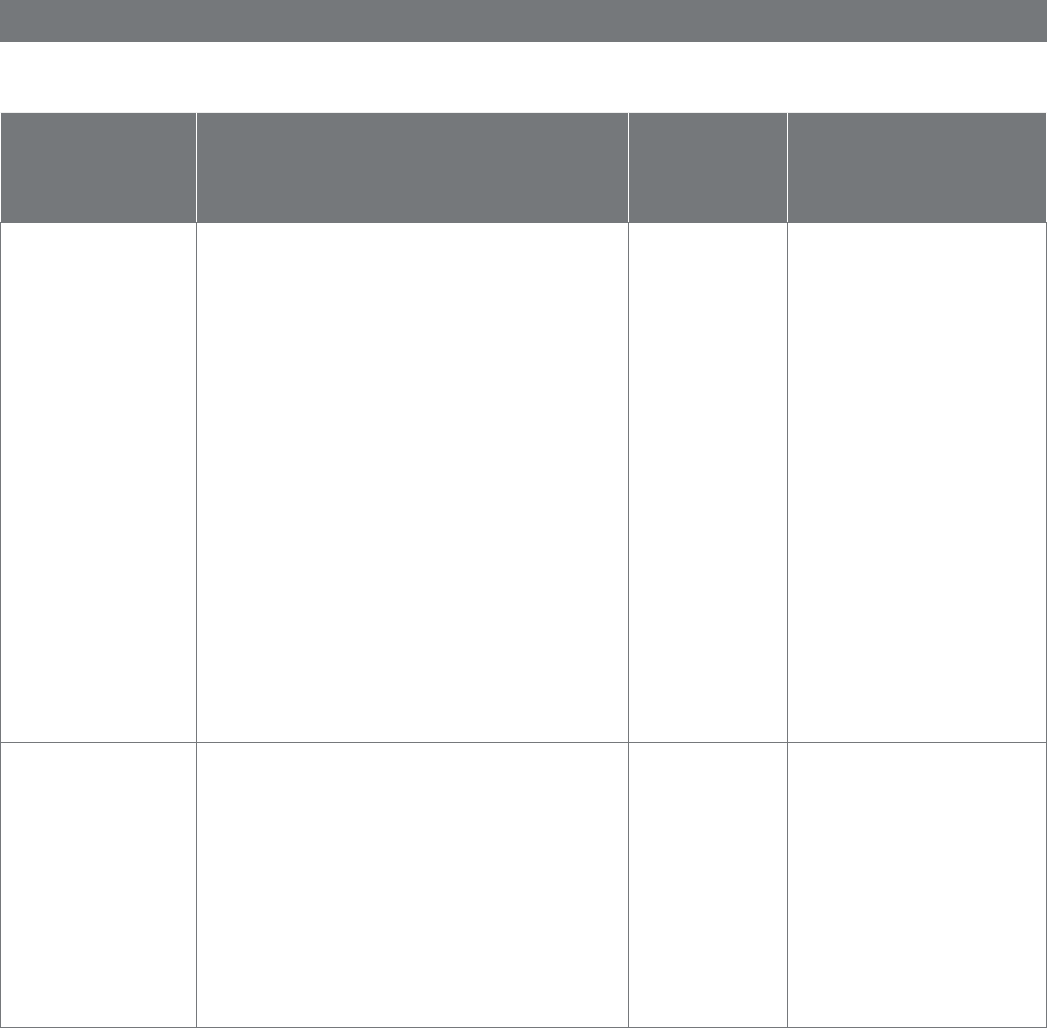

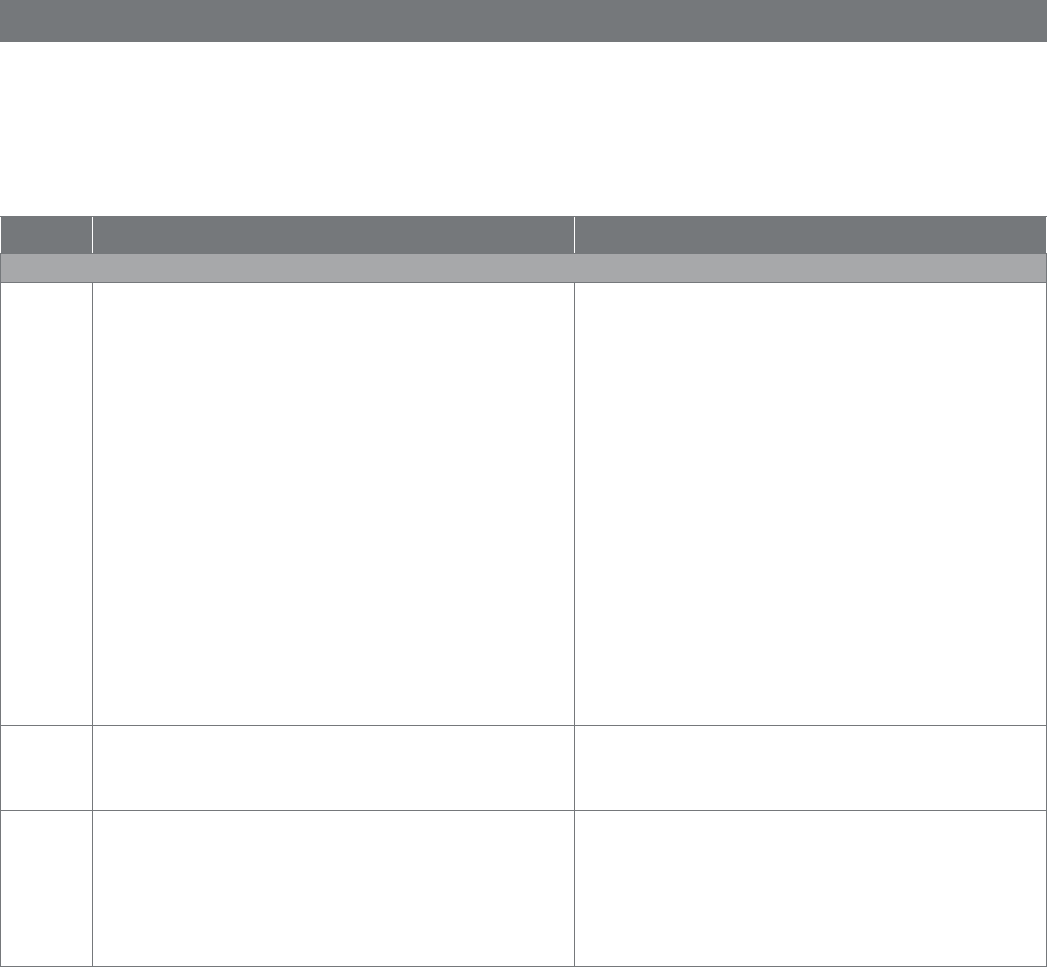

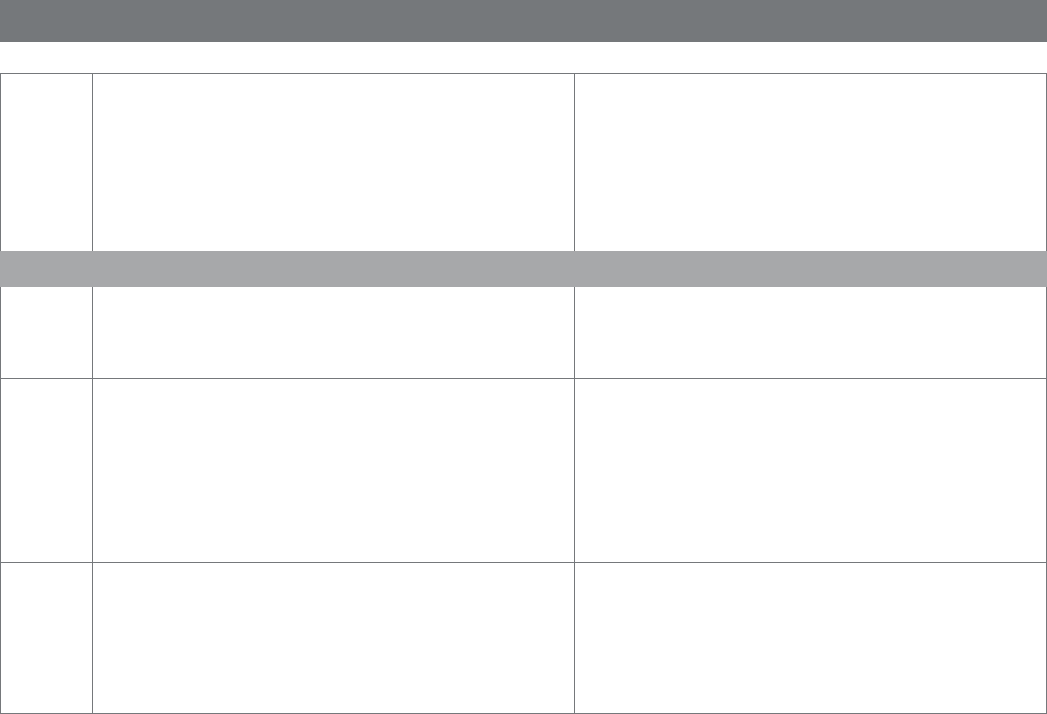

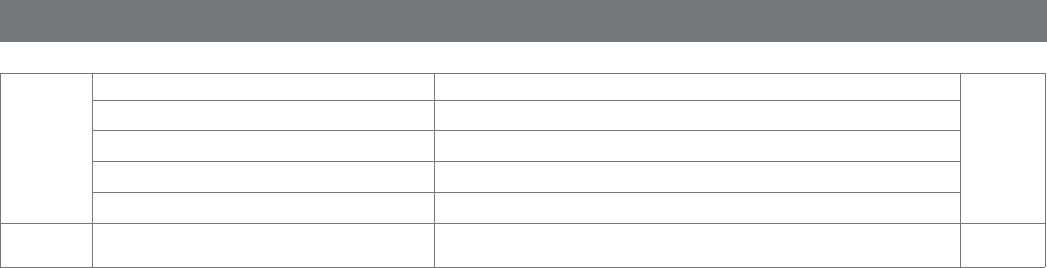

Examples

The below examples are provided for illustrative purposes only. Each claim will be assessed individually, based on the facts relative to the specic

claim

Example A – Excess applied:

Example B – Excess and depreciation

applied:

Example C – Excess and depreciation applied to

more than one Event:

Anna books accommodation to the Sunshiny

caravan park. Her Trip with the family is in

summer, which is 3 months away. A week

before the start of the family Trip, her son

has an accident at school and breaks his leg.

Unfortunately, he needs surgery and the Doctor

conrms it’s best to be at home for the recovery.

Anna paid $1,200 for the accommodation. The

Excess is $250.

a) Deduct the Excess of $250

b) Check the total cover limits and sub limits

in the Schedule of Benets. The amount

claimable is below these limits.

Calculation for the amount payable:

(-Excess) + accommodation = amount payable

(-$250) + $1,200 = $950 claim payment.

Jane travels to Brazil and while in Brazil her

laptop is stolen. She reports the theft to the

police and provides Us with the required

documentation. Jane paid $6,000 for her

laptop 12 months prior to this Event. Jane’s

Excess is $250.

a) Deduct the Excess of $250

b) Establish original purchase price of the

laptop: $6,000

c) Apply depreciation*:

• 2.5% per month for 12 months = 30%

depreciation.

• 30% of $6,000 = $1,800 total

depreciation.

d) Establish current value of the laptop

by subtracting depreciation from the

purchase price of the laptop

• $6,000 - $1,800 = $4,200

e) Check the total and per item limit shown

in the Schedule of Benets and select the

lower of current value of the laptop or the

item limit. If the per item limit is $2,500

which is lower than the current value

$4,200, hence We take the lower number

= $2,500.

Calculation for the amount payable:

(-Excess) + limit per item = amount payable

(-$250) + $2,500 = $2,250 claim payment.

Rob and his wife travelled to France for 14 days. On

the 4th day of their Trip, Rob slips down the stairs

at the hotel. Thankfully it’s not a major injury, but

he did twist his ankle and needs to seek medical

attention. He was billed $500 for the Doctor’s

appointment including some scans and medication.

On the 8th day, Rob had his laptop stolen, which

was worth $1,000 when it was purchased 6 months

ago. Unfortunately, on the last day of their Trip,

Rob’s wife then lost her Smartphone worth $900

that was purchased directly before their Trip

commenced. When they return to Australia, Rob

submitted a claim for the 3 Events.

As Rob and his wife had 3 Events during their Trip to

France, an Excess would be applied to each of the

Events (and Covered Persons).

Claim 1: (-$250) Excess + $500 Medical costs =

$250 claim payment.

Claim 2:

a) Deduct the Excess of $250

b) Establish original purchase price of the laptop:

$1,000

c) Apply depreciation*:

• 2.5% per month for 6 months = 15%

depreciation.

• 15% of $1,000 = $150 total depreciation.

d) Establish current value of the laptop by

subtracting depreciation from the purchase

price of the laptop

• $1,000 - $150 = $850

Calculation for the amount payable:

(-Excess) + current value = amount payable

(-$250) + $850 = $600 claim payment.

Claim 3: (-$250) Excess + $900 Smartphone =

$650 claim payment.

*For depreciation details, please review Section G – Personal Baggage, Valuables, Money and Travel Documents Cover

The applicable Excess amount is specied in the Schedule of Benets.

An Excess may also be a waiting period, which is the amount of time You have to wait until the benet may become payable.

THE AMERICAN EXPRESS PLATINUM CARD

3

Pre-Existing Medical Conditions

This Policy does not cover any costs incurred from or relating to any

Pre-Existing Medical Condition under Sections A – L (below). For example,

it does not provide cover if You need emergency medical treatment

overseas for an existing illness or if You need to Cancel Your Trip because a

Close Relative’s existing medical condition deteriorates before You travel.

If You have Pre-Existing Medical Conditions, this cover may not be right for

You. Before You make Your Qualifying Travel Purchase, You should review

this Policy to make sure it provides the right cover for You and Your

health situation.

Pregnancy & Travel Insurance Benets

It’s important to understand how Your travel insurance benets under this

Policy may be limited if You are pregnant. These are summarised below.

When does the travel insurance cover You if You are pregnant?

If You are pregnant, You will be covered for unforeseen emergency medical

treatment whilst overseas up to 8 weeks before Your estimated date of

delivery. However, You will not be covered for costs associated with the

actual birth of Your child overseas or any pregnancy related medical

conditions that You were already suering before Your Qualifying Travel

Purchase. For more information see – When are You Not Covered if You

are pregnant? (below).

Two key sections of this Policy that You should be aware of are:

1. Section E - Medical Emergency Expenses Cover:

You are covered for Events arising from or related to Your pregnancy

when You are on an International Return Trip, if You have a sudden and

unexpected Injury or Illness, which:

a) occurs more than 8 weeks before Your estimated date of delivery; and

b) is not otherwise excluded within this Policy.

2. Section A - Trip Cancellation and Amendment Cover:

You are covered if You have a sudden and unexpected Injury or Illness

arising from or related to Your pregnancy that prevents You from going on

the Trip or continuing the Trip, and which:

a) is conrmed by medical evidence provided by a treating Doctor;

b) occurs more than 8 weeks before Your estimated date of delivery; and

c) is not otherwise excluded within this Policy.

When Are You Not Covered if You are pregnant?

You are not covered for any costs arising from or related to:

1. any Pre-Existing Medical Condition;

2. any past medical condition(s) relating to a previous pregnancy

or if You have experienced pregnancy complications prior to Your

Qualifying Travel Purchase;

3. Your pregnancy under Medical Emergency Expenses Cover or

Trip Cancellation and Amendment Cover within 8 weeks of Your

estimated date of delivery;

4. any costs under Medical Emergency Expenses Cover arising from

childbirth or the health of a newborn child. This exclusion applies

irrespective of the stage of pregnancy at which the child is born;

meaning a newborn (whether premature or otherwise) is not

considered a Covered Person under this Policy if the child was born

on the Trip;

5. any costs under Medical Emergency Expenses Cover arising from

or relating to an abortion, unless an abortion is medically necessary

to protect the health and safety of the mother following an Injury or

Illness, as determined by a treating Doctor;

6. fertility treatment or treatment associated with an assisted

reproduction program including but not limited to, in vitro

fertilisation (IVF).

Exclusions Within This Policy

As with all insurance, there are certain exclusions that apply. Some

exclusions only apply to certain benets under this Policy, while other

exclusions apply to all claims. You should read the following:

a) General Exclusions and General Conditions sections within this Policy,

which apply to all claims.

b) Each cover section includes information about what We cover and any

terms and conditions and exclusions that apply to the cover section.

To ensure You understand when We will pay for a claim, You should read

each section carefully. You should make sure to check this Policy

before You travel to make sure that You, and all the things You want to do,

are covered.

4

THE AMERICAN EXPRESS PLATINUM CARD

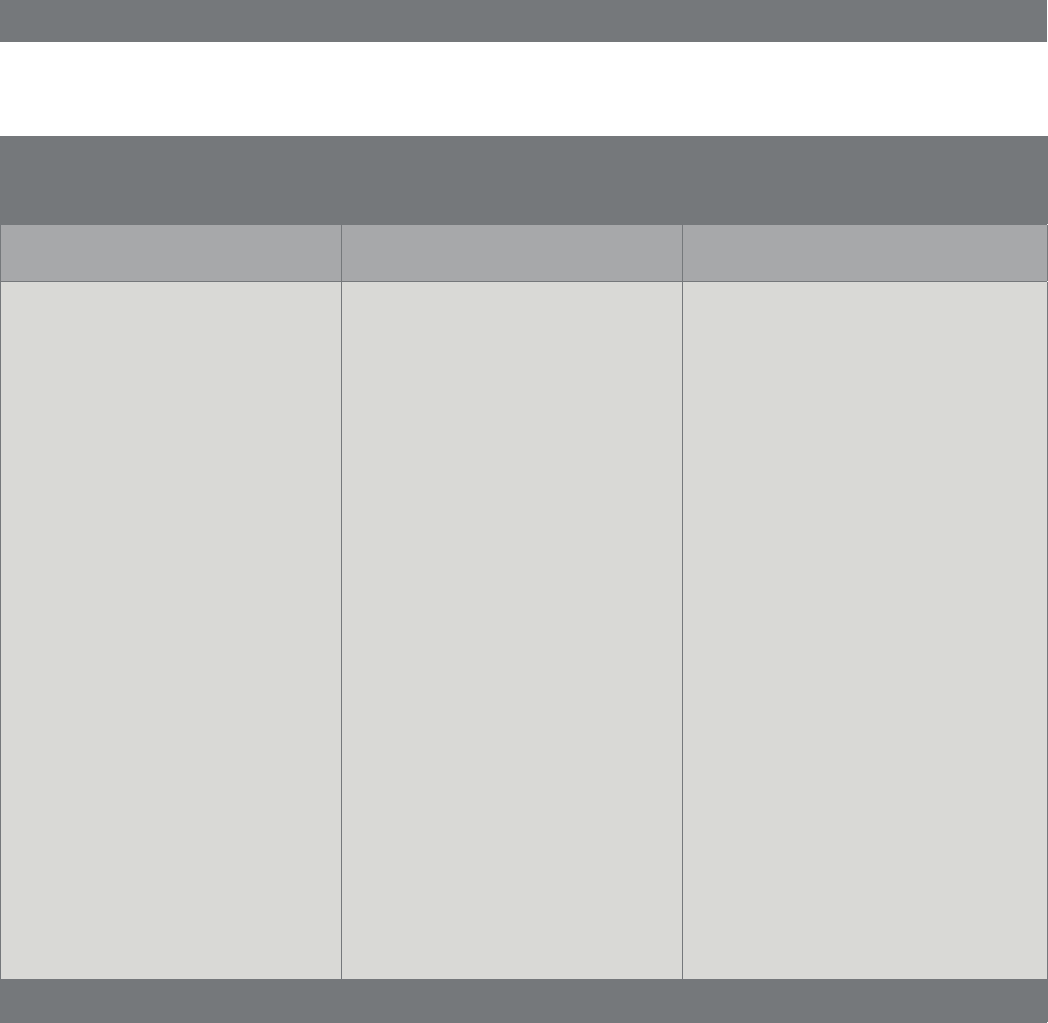

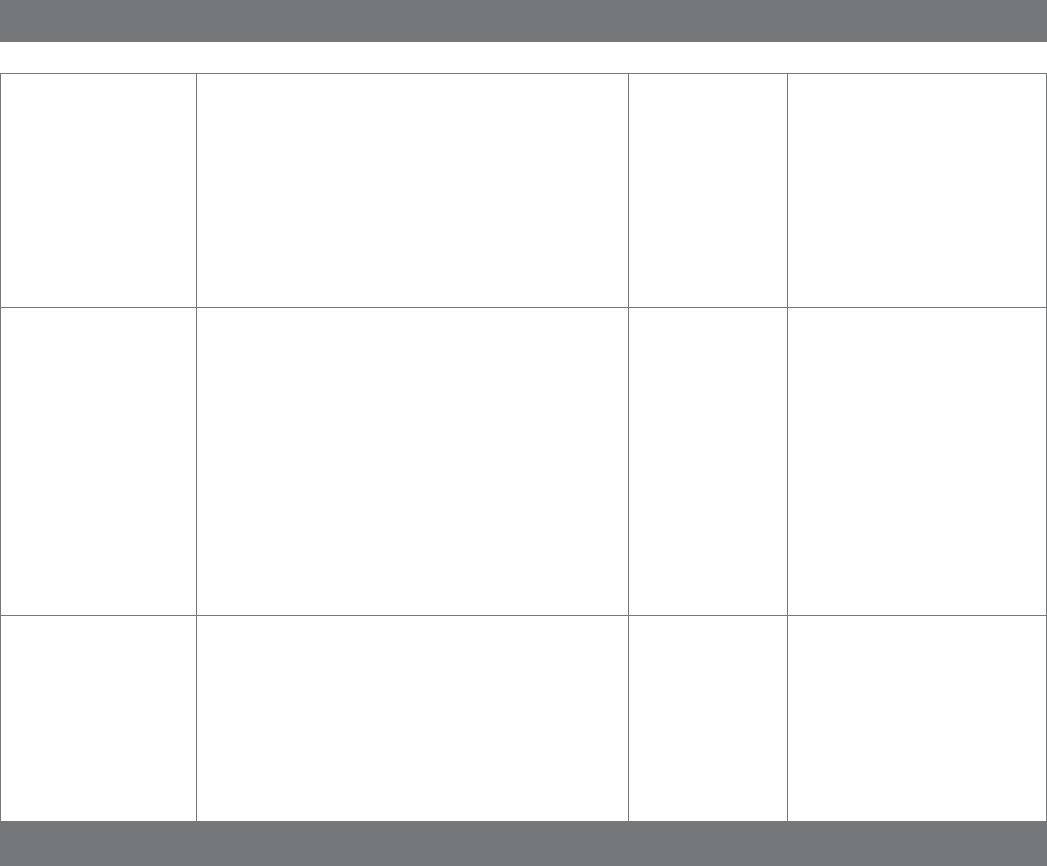

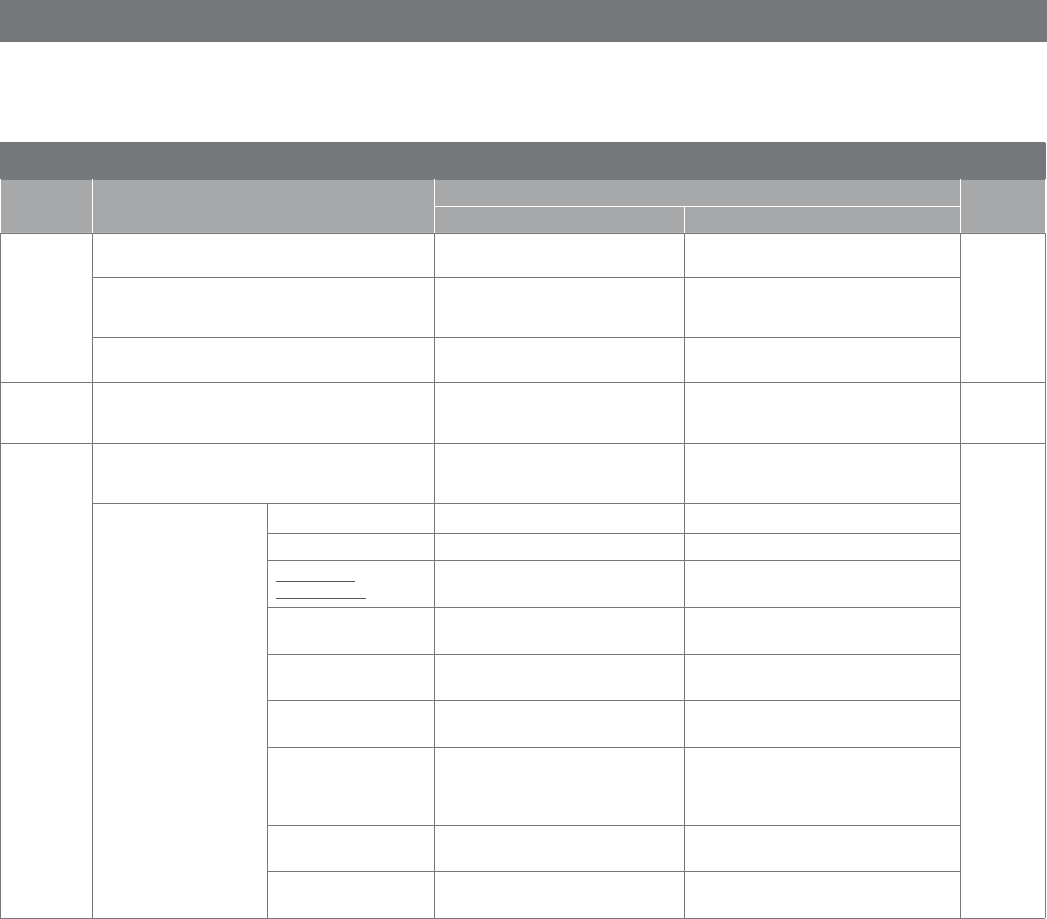

Age Limits

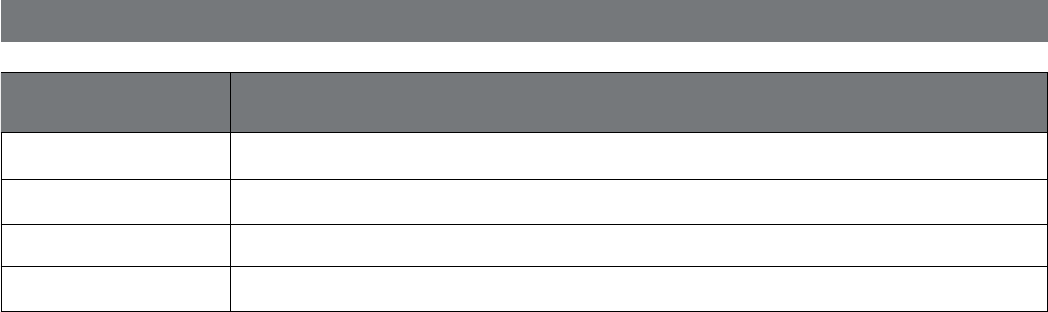

Please note that to be eligible for some of the benets under this Policy, age limits apply. Please see the table below for a summary of the age limits that apply

within this Policy.

Cover Section Age Limit

Age Limit for Covered Person

Travel Insurance Cover (Section A and Sections C - K)

Card Account Balance Waiver Cover (Section B)

You must be 79 years of age or younger before You make Your Qualifying

Travel Purchase.

Loss Damage Waiver Cover (Section L) You must be 21 years of age or older and under 80 years of age before You

make Your Qualifying Rental Vehicle Purchase.

Card Purchase Cover (Section M)

Card Refund Cover (Section N)

Buyers Advantage Cover (Section O)

Smartphone Screen Cover (Section P)

No age limitations apply for these cover sections.

Legal Assistance (Section Q)

Roadside Assistance (Section R)

Home Assistance (Section S)

Age Limit for Close Relative or Travelling Companion

If Your claim relates to the cancellation or disruption of Your Trip due to an

Injury or Illness of Your Close Relative or Travelling Companion, age limits

also apply

Trip Cancellation and Amendment Cover (Section A)

Resumption of Long International Trip Cover (Section F)

Close Relative or Travelling Companion must be 90 years of age or younger

when You make Your Qualifying Travel Purchase.

Excluded Sports And Activities

Not everything You do on Your Trip will be covered by this Policy. This includes

• some popular holiday activities such as bungee jumping, jet skiing, horse riding or trekking (with climbing equipment or when You ascend more than 3,000

metres from sea level).

• competitive sporting events (for example, where You may receive a fee or prize money).

Please see the denition of ‘Excluded Sports and Activities’ for a full list of activities and sports which are not covered under this Policy.

THE AMERICAN EXPRESS PLATINUM CARD

5

COVID-19

This Policy provides some limited cover related to Coronavirus Disease 19

(COVID-19) as outlined below. All claims are subject to the usual Policy

terms, conditions and exclusions.

Domestic Return Trips (Limited Cover only)

• If You need to change, Curtail or Cancel Your Domestic Return Trip

due to You, Your Travelling Companion, Your Close Relative or a person

You are visiting for the main purpose of Your Trip being diagnosed

with COVID-19, You will be eligible to claim under Section A - Trip

Cancellation and Amendment Cover.

• There is no Cancellation, Curtailment or Trip Change cover due to

border closures or travel advisory warnings related to COVID-19 for

Domestic Return Trips.

• There is no Medical Emergency Expenses cover for Domestic

Return Trips.

International Return Trips

• If You need to Curtail, Cancel or make a Trip Change to Your

International Return Trip due to You, Your Travelling Companion, Your

Close Relative or a person You are visiting for the main purpose of Your

Trip being diagnosed with COVID-19, You will be eligible to claim under

Section A - Trip Cancellation and Amendment Cover.

• If You need to cancel, curtail or change Your International Return

Trip because of border closures or travel advisory warnings due

to COVID-19, You will be eligible to claim under Section A – Trip

Cancellation and Amendment Cover.

- Cancellation cover - applies for border closures or upgraded travel

advisory warnings which occur after You make Your Qualifying Travel

Purchase for International Return Trips.

- Curtailment or Trip Change cover - applies for border closures or

upgraded travel advisory warnings which occur after You start Your

International Return Trip.

• If You become ill with COVID-19 whilst on an International Return Trip,

You will be eligible to claim under Section E – Medical Emergency

Expenses Cover. Please note:

- there is no cover if You travel when a ‘Do Not Travel’ travel advisory

warning has been issued by an Australian State or Territory or the

Australian Federal Government or an Australian government agency

(such as the Department of Foreign Aairs (DFAT)) prior to Your

Trip starting – even if You have an exemption to travel from the

Australian Government or an Australian government agency.

- there is no cover if You travel when the borders have been closed at

Your destination prior to Your Trip starting.

Cancellation or Postponement of Special Events (No Cover)

There is no cover for the cancellation or postponement of a Special Event

(for example, a wedding, conference, concert or sporting event) in Australia

or overseas arising from or related to COVID-19.

Please refer to each policy section for a full overview of the cover, terms,

conditions and exclusions that apply.

Travelling Against Medical or Government Advice

If You are advised not to travel or not to go on a particular Trip (for example,

to a specic destination), You must comply with that advice. You will not

be covered under Sections A – K of this Policy if You start a Trip against the

following advice:

(a) a treating Doctor advises You not to travel; or

(b) an Australian State or Territory or the Australian Federal Government

or an Australian government agency (such as DFAT) advises You not

to travel (for example, through border closures or ‘Do Not Travel’

travel advisories). This exclusion applies even if You have been

granted a travel exemption by an Australian State or Territory, the

Australian Federal Government or an Australian government agency

(such as DFAT) to travel.

If You are advised not to travel after You have made Your Qualifying Travel

Purchase, You may be entitled to cancel or change Your Trip and make a

claim under Section A - Trip Cancellation and Amendment Cover (subject

to the terms and conditions of this Policy).

Return Trips Only

You are only eligible for the travel insurance benets under Sections A – K

of this Policy for return Trips i.e. trips that begin and end from Your Home

or Work in Australia. It does not cover One-Way Trips where You have no

plans to return to Australia.

You may need to provide evidence of Your intention to return to Your Home

or Your Work where reasonably possible, for example by providing copies

of a return ticket, itinerary or schedule, return transfer or accommodation

bookings, conrmation of return to Work dates etc. Remember, cover

automatically ends for all Trips at 180 days.

Loss Damage Waiver Cover for Rental Vehicles

For Rental Vehicle hire of less than 31 days that are paid for on Your

American Express Card Account, this Policy provides cover for costs

that You are responsible for under Your Rental Agreement with a Rental

Company. Loss Damage Waiver cover does not extend to all vehicles that

You may wish to hire. For example, motorcycles, campervans and buses

(except for mini buses hired for recreational purposes) are not covered.

Fraud

Chubb takes insurance fraud seriously. Creation or submission of false

documents, or exaggerating a genuine claim is considered insurance

fraud. Such behaviour has a negative impact on the cost of insurance for

all customers.

We use Our dedicated special investigations unit at Chubb to detect and

investigate selected claims daily. When the evidence supports it, Chubb will

report suspect claims to the police and dedicate resources to assisting any

potential criminal prosecutions.

6

THE AMERICAN EXPRESS PLATINUM CARD

Australian Law

Your Policy is governed by the laws of the State or Territory of Australia

where Your Home is. Any dispute or action in connection with Your Policy

will be conducted and determined in the courts of the State or Territory of

Australia in which Your Home is.

Australian Currency

All payments made under this Policy must be in Australian currency.

Chubb Assistance (In The Event Of An

Emergency)

Emergency assistance around the world

In the event of a medical emergency whilst overseas simply phone

+61 2 8907 5666 to get immediate help in locating medical assistance in

Your local area.

For all non-emergency matters, contact Chubb Customer Service on

1800 236 023, or You can submit Your claim online by visiting the Chubb

Claims Centre for American Express:

www.americanexpress.com/australia/claims

Where Your claim is excluded or falls outside this Policy coverage, We

may still provide You with some emergency assistance. If We do this, the

provision of emergency assistance by Chubb Assistance will not in itself be

an admission of liability.

Considerable eort is made to locate, assess and reassess medical

facilities and other services worldwide. However, the medical standards,

sanitary conditions, reliability of telephone systems and facilities for

medical services dier from country to country and accordingly, it is not

always possible to have control over these factors. In the circumstances,

responsibility for any loss, medical complication or death resulting from

any factor beyond Our control, cannot be accepted by Chubb Assistance

or Us.

Eligibility For Cover Under This Policy

Cover under this Policy is only available to Card Members who meet the

eligibility criteria. You need to use Your American Express Card Account

in accordance with the Eligibility Table below. Not all cover sections have

the same eligibility criteria, so it is important You understand when the

benets under this Policy become available to You.

THE AMERICAN EXPRESS PLATINUM CARD

7

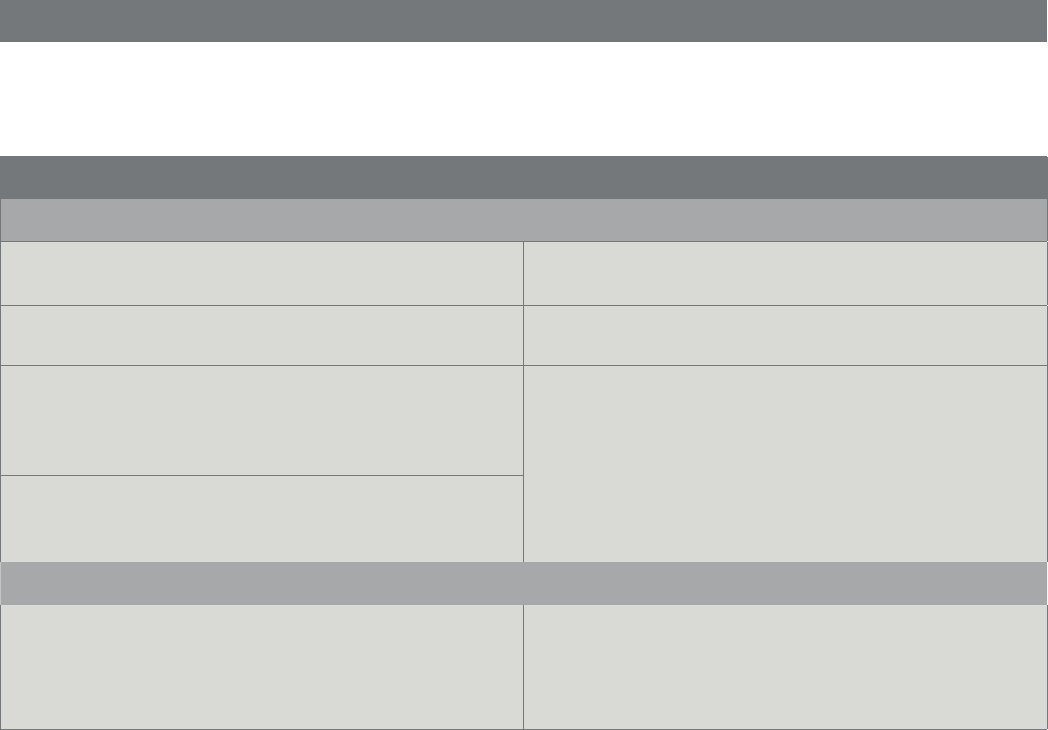

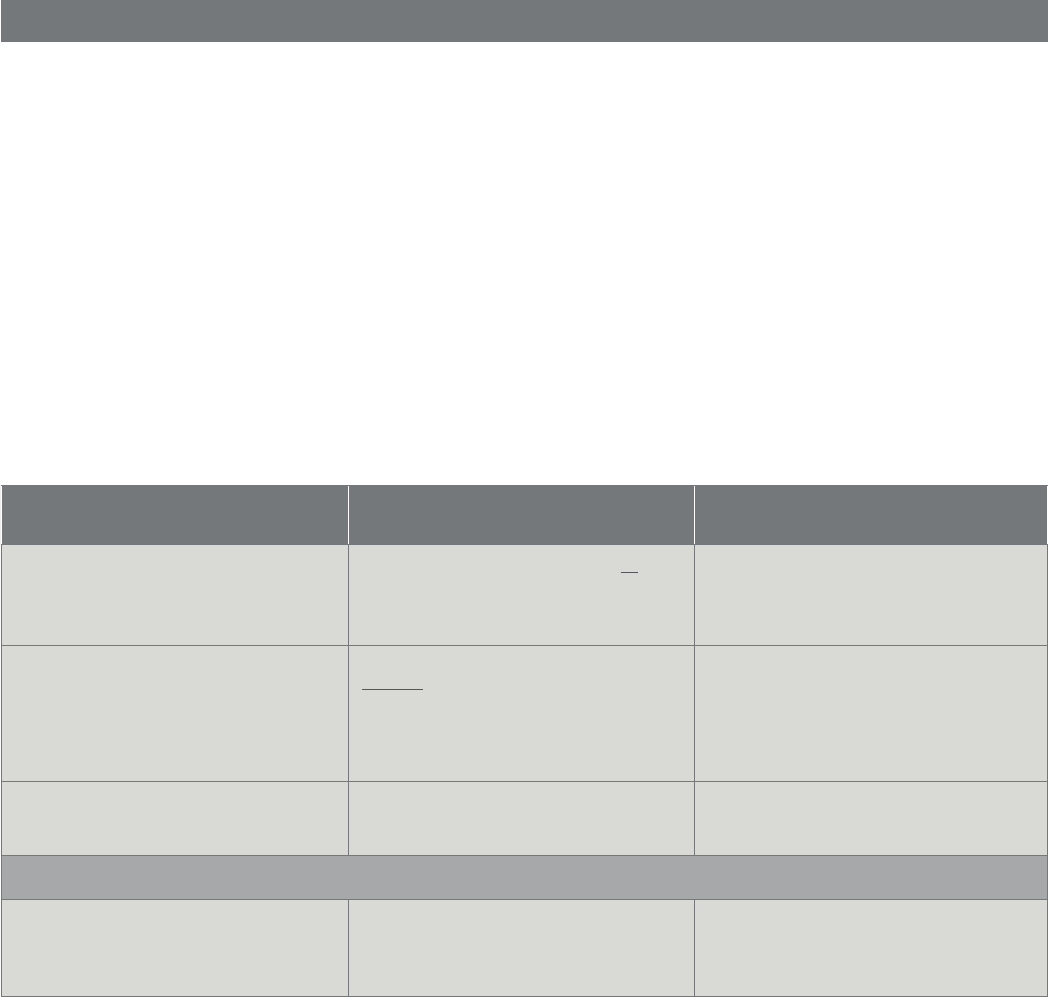

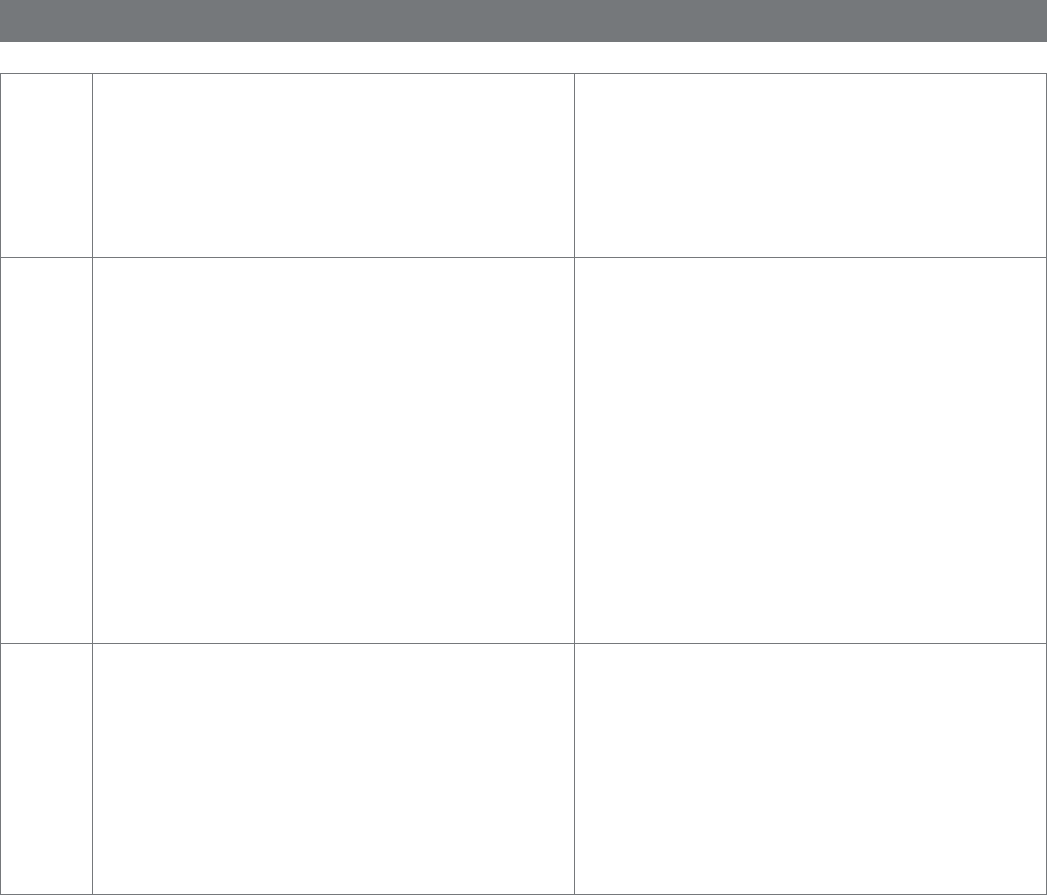

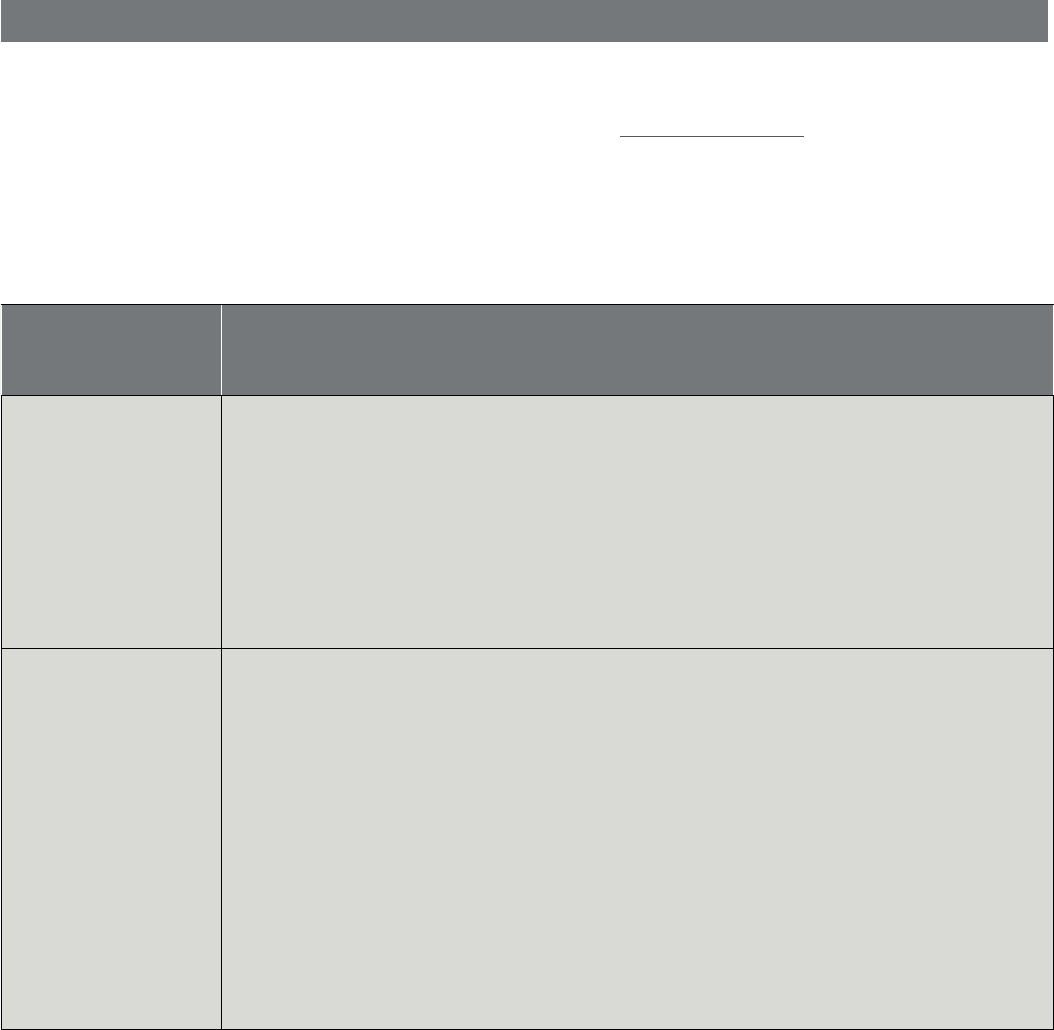

Cover Section

Eligibility Criteria

To be eligible for the benets under the cover section(s) of the

Policy, the following eligibility criterianeed to be met:

When are benets

available

under the Policy?

When are no benets available

under this Policy?

Travel Insurance Cover

(Section A and

Sections C - K)

Card Account Balance

Waiver Cover (Section B)

1. You are a Card Member or an Additional Card Member or their:

a. Spouse; or

b. Dependent Child.

2. You are a Resident of Australia.

Domestic Return Trips

3. You are going on a Domestic Return Trip and You either:

a. spend $500 or more on accommodation; or

b. Pay the full amount of Your outbound ticket for a

Scheduled Flight, Scheduled Cruise, bus or train to Your

scheduled outbound destination,

on Your:

i. American Express Card Account;

ii. corresponding American Express Membership

Rewards points or frequent yer points (where

applicable); and/or

iii. Travel Benet.

International Return Trips

4. You are going on an International Return Trip and You pay the

full amount of Your outbound ticket for a Scheduled Flight or

Scheduled Cruise leaving Australia on Your:

i. American Express Card Account;

ii. corresponding American Express Membership Rewards

points or frequent yer points (where applicable); and/or

iii. Travel Benet.

5. You hold an eligible American Express Card Account which is

current (meaning it is not cancelled or suspended).

6. You are 79 years of age or younger when You make Your

Qualifying Travel Purchase.

If You have satised

the eligibility criteria,

You will be eligible

to make a claim for

the Domestic Return

Trip or International

Return Trip that

eligibility condition 3

or 4 applies to.

There is no cover under this Policy if:

1. You do not meet the

eligibility criteria;

2. Your American Express Card

Account has been cancelled

or suspended;

3. You are going on a One-Way Trip.

Please also refer to the Terms,

Conditions and Exclusions within

each cover section (A – K below) and

the General Exclusions and General

Conditions within this Policy.

Loss Damage Waiver

Cover (Section L)

1. You are a Card Member or an Additional Card Member or their:

a. Spouse; or

b. Dependent Child.

2. You are a Resident of Australia.

3. You pay the entire cost for renting a Rental Vehicle using Your:

i. American Express Card Account; and/or

ii. corresponding American Express Membership Rewards

points; and/or

iii. Travel Benet.

4. You hold an eligible American Express Card Account which is

current (meaning it is not cancelled or suspended).

5. You are 21 years of age or older and 79 years of age or younger

when You make Your Qualifying Rental Vehicle Purchase.

If You have satised

the eligibility criteria,

You will be eligible to

make a claim for the

Rental Vehicle that

eligibility condition 3

applies to.

There is no cover under this Policy if:

1. You do not meet the

eligibility criteria;

2. Your American Express Card

Account has been cancelled or

suspended.

Please also refer to the Terms,

Conditions and Exclusions within

cover section (L) and the General

Exclusions and General Conditions

within this Policy.

Eligibility Table

8

THE AMERICAN EXPRESS PLATINUM CARD

Card Purchase Cover

(Section M)

Card Refund Cover

(Section N)

Buyer's Advantage Cover

(Section O)

1. You are a Card Member or an Additional Card Member or their:

a. Spouse; or

b. Dependent Child.

2. You are a Resident of Australia.

3. You purchase an Eligible Item and pay the entire cost

using Your:

i. American Express Card Account; and/or

ii. corresponding American Express Membership

Rewards points.

4. You hold an eligible American Express Card Account which is

current (meaning it is not cancelled or suspended).

If You have satised

the eligibility criteria,

You will be eligible

to make a claim for

the Eligible Item that

eligibility condition 3

applies to.

There is no cover under this Policy if:

1. You do not meet the

eligibility criteria;

2. Your American Express Card

Account has been cancelled

or suspended.

Please also refer to the Terms,

Conditions and Exclusions within

each cover section (M, N or O below)

and the General Exclusions and

General Conditions within this Policy.

Smartphone Screen

Cover (Section P)

1. You are a Card Member or an Additional Card Member or their:

a. Spouse; or

b. Dependent Child.

2. You are a Resident of Australia.

3. You pay the cost of a:

a. Smartphone outright in 1 single transaction, or

b. Smartphone Data Plan for 3 consecutive months

immediately prior to the front screen breakage;

using Your:

i. American Express Card Account; and/or

ii. corresponding American Express Membership

Rewards points.

4. You hold an American Express Card Account which is current

(meaning it is not cancelled or suspended).

If You have satised

the eligibility criteria,

You will be eligible

to make a claim for

the Smartphone that

eligibility condition 3

applies to.

There is no cover under this Policy if:

1. You do not meet the

eligibility criteria;

2. Your American Express Card

Account has been cancelled

or suspended.

Please also refer to the Terms,

Conditions and Exclusions within

cover section (P) and the General

Exclusions and General Conditions

within this Policy.

Assistance Services

Legal Assistance

(Section Q)

Roadside Assistance

(Section R)

Home Assistance

(Section S)

1. You are a Card Member or an Additional Card Member or their:

a. Spouse;

b. Dependent Child.

2. You are a Resident of Australia.

3. You hold an eligible American Express Card Account which is

current (meaning it is not cancelled or suspended).

If You have satised

the eligibility criteria,

the Assistance

Services provided

for in this Policy are

available to You.

There is no cover under this Policy if:

1. You do not meet the eligibility

criteria;

2. Your American Express Card

Account has been cancelled or

suspended.

Please also refer to the Terms,

Conditions and Exclusions within

each cover section (Q, R and S) and

the General Exclusions and General

Conditions within this Policy.

IMPORTANT INFORMATION: American Express has the right to change or terminate the Group Policy and your insurance benets under it. American

Express will always notify you before making any change to the Group Policy that materially impacts your insurance benets.

THE AMERICAN EXPRESS PLATINUM CARD

9

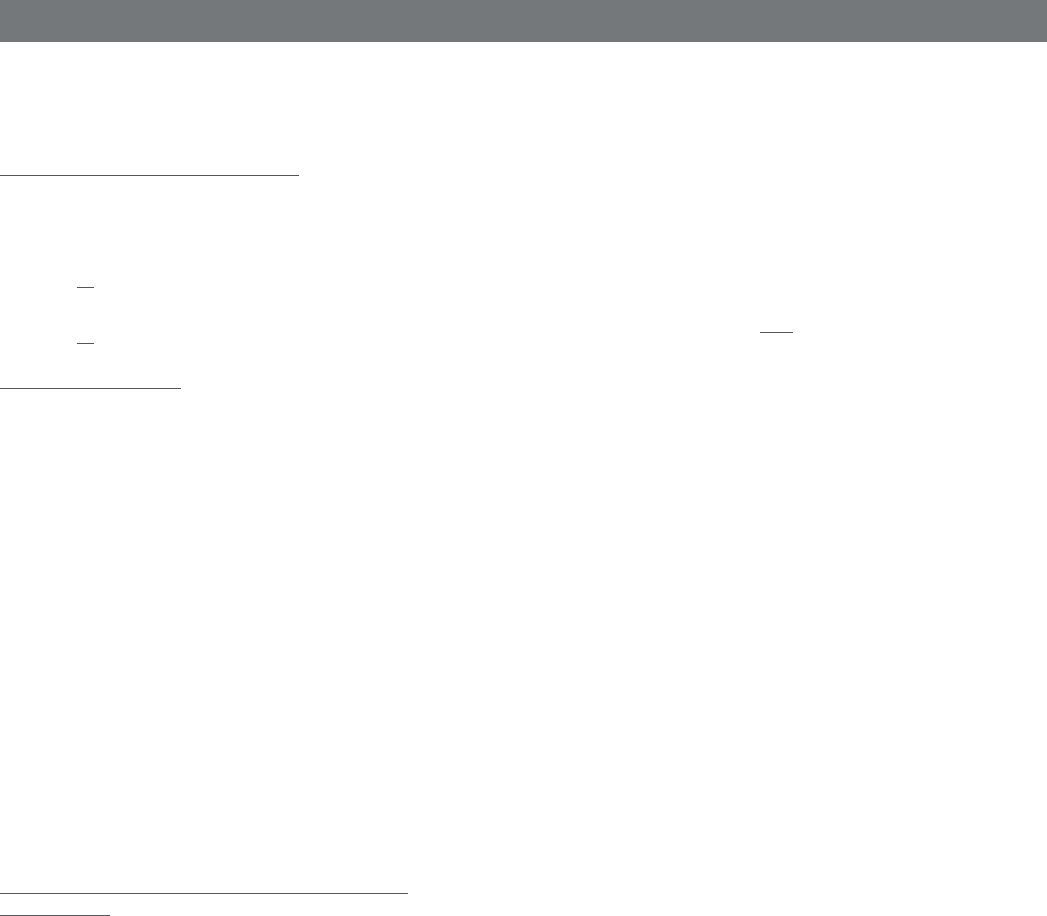

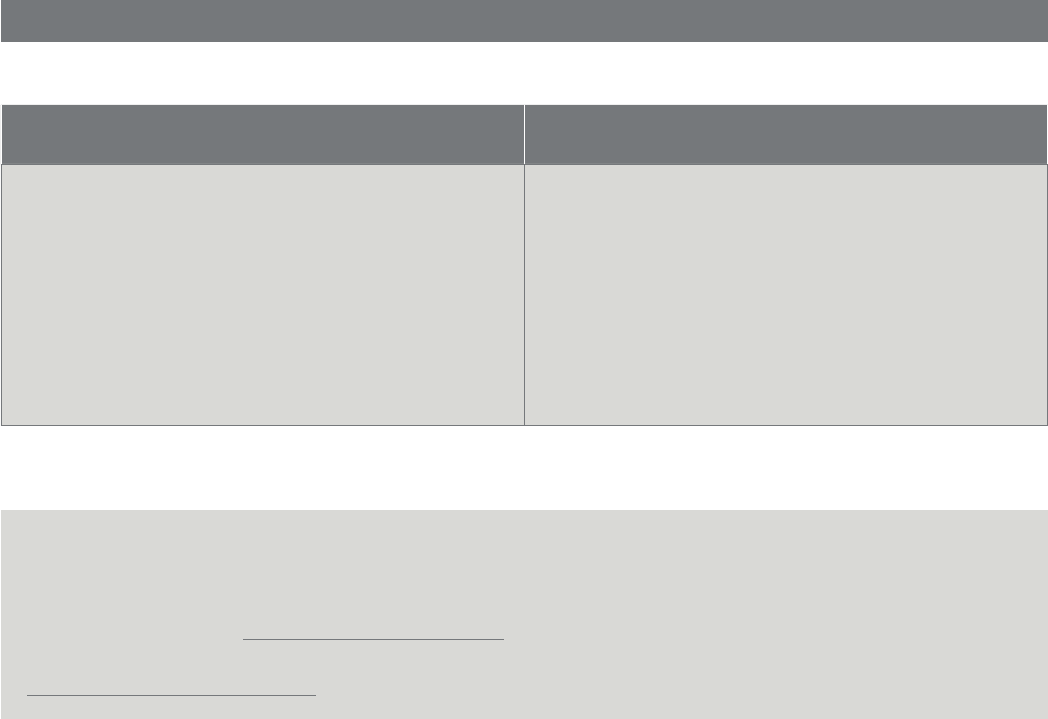

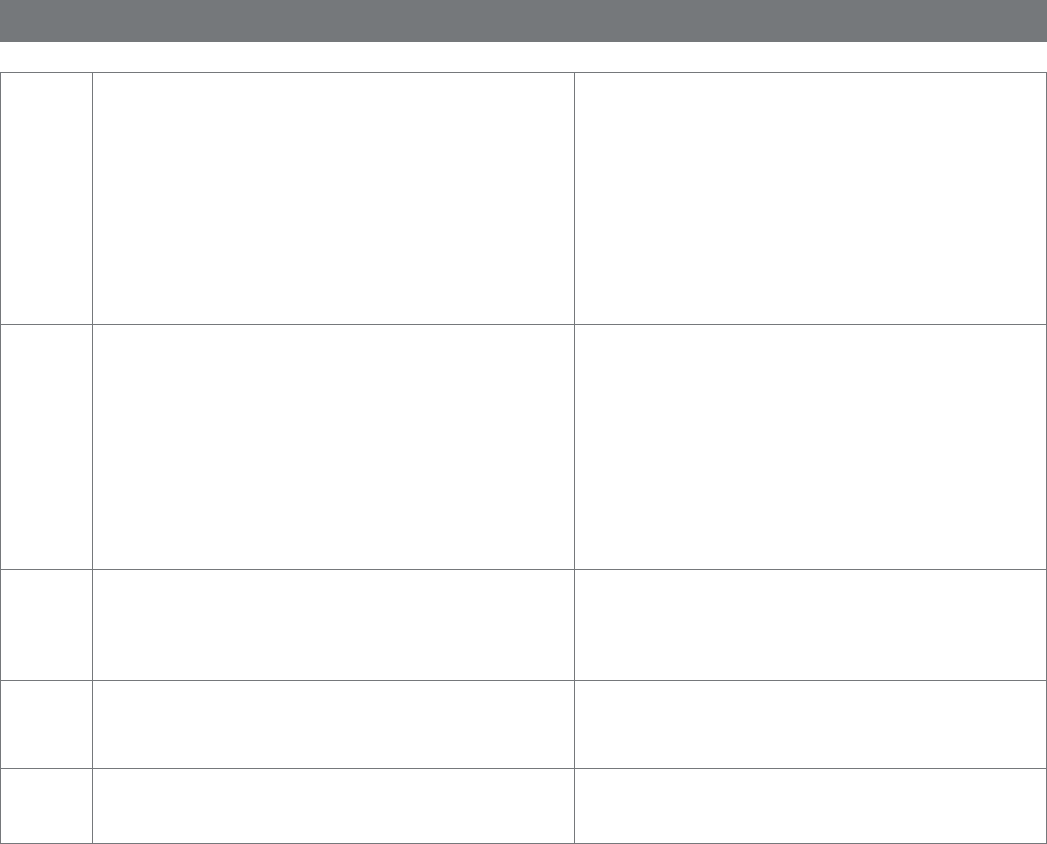

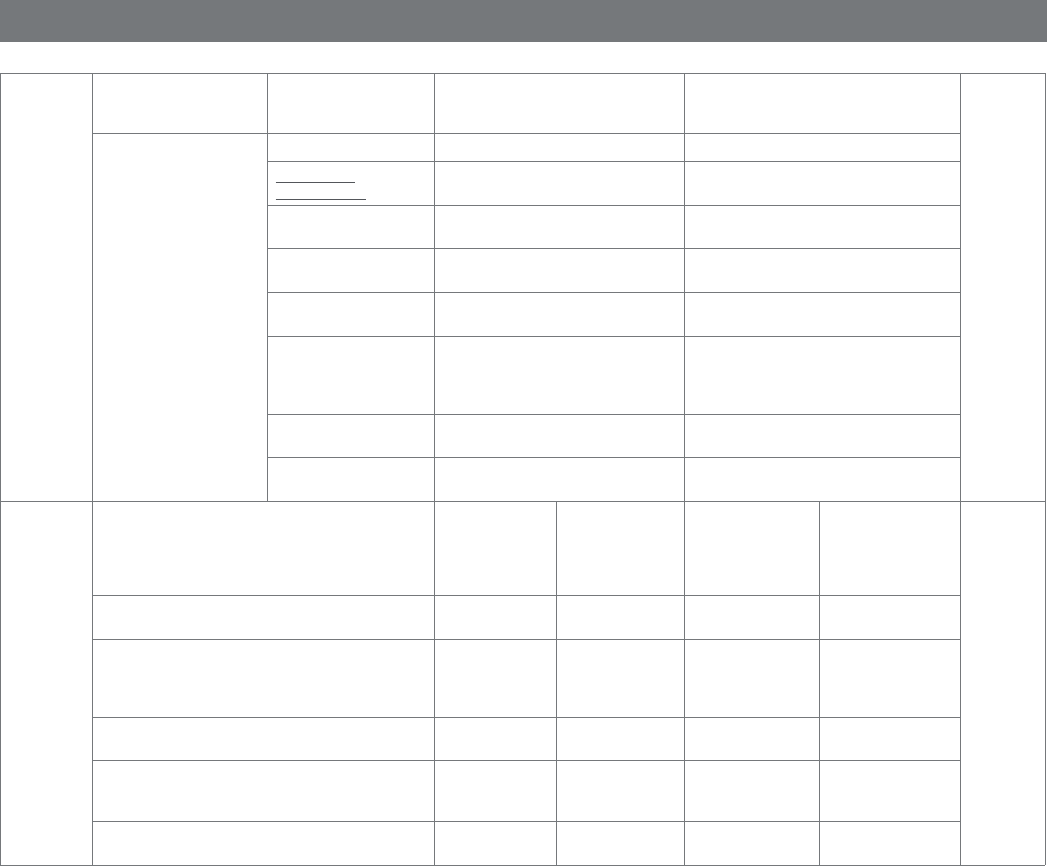

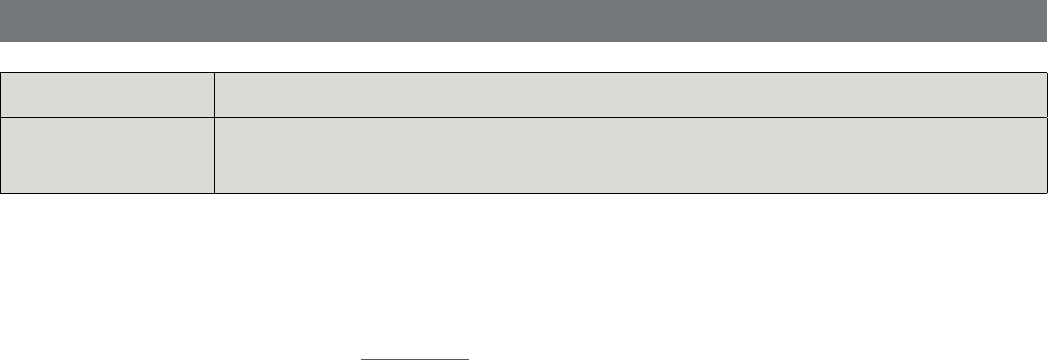

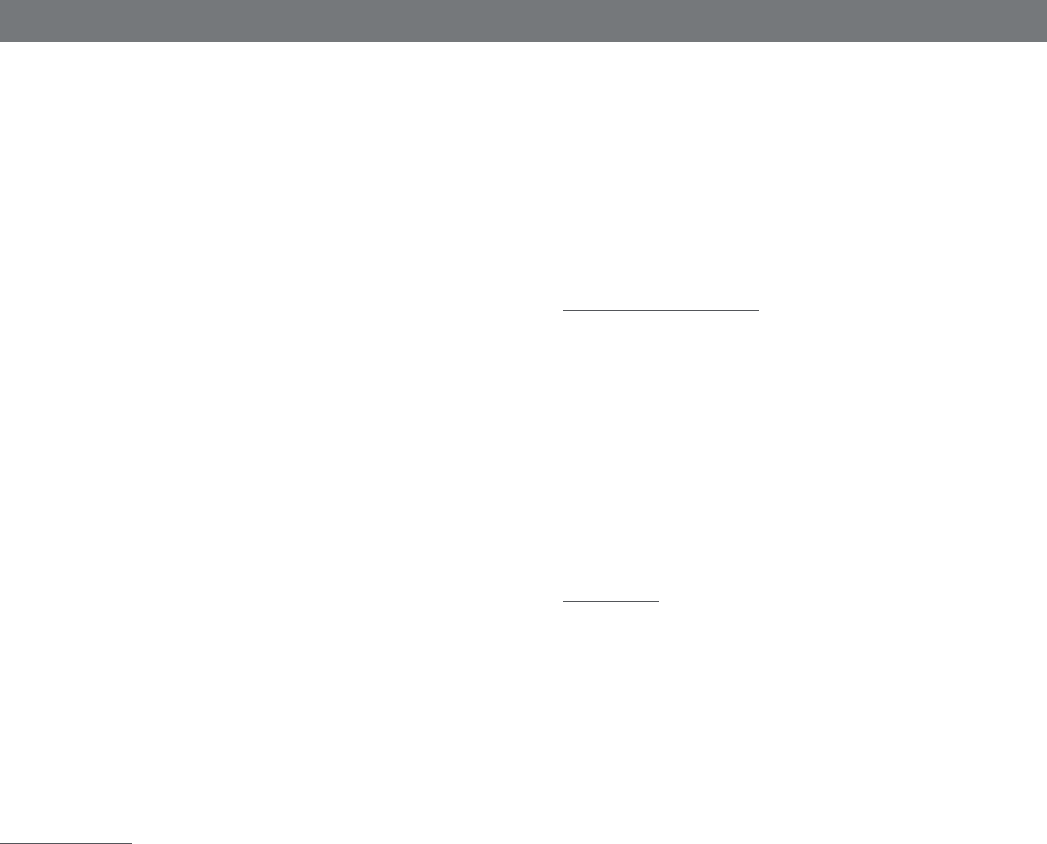

American Express Card at the date of

Qualifying Purchase

American Express card at the date of claim

Event

Which policy applies?

Your American Express Card Account product

associated with this Policy.

A dierent American Express card with no

insurance benets.

This Policy will not apply as you changed Your

American Express Card. This means there is no

cover under this Policy.

See Example A below.

Your American Express Card Account product

associated with this Policy.

A different American Express card with

different insurance benets (i.e. where you

upgrade or downgrade to a dierent card).

This Policy will not apply as you changed Your

American Express card.

The policy of your new American Express card will

apply, subject to the terms, conditions, limits and

exclusions of that policy.

See Example B below.

A different American Express card product with

or without insurance benets.

Your American Express Card Account associated

with this Policy.

This Policy will apply. Cover is subject to the

terms, conditions, limits and exclusions of

this Policy.

Card Suspension or Cancellation

Your American Express Card Account product

associated with this Policy.

Your American Express Card Account has been

cancelled or suspended.

This Policy does not apply; there are no insurance

benets available to you as your American

Express Card Account has been cancelled

or suspended.

If You change Your American Express Card

Account product, or Your American Express Card

Account is Cancelled or Suspended

If You change Your American Express Card Account product to another

card oered by American Express (e.g. a card downgrade or upgrade), you

will not be entitled to cover under this Policy and the insurance benets

will stop.

The card you hold at the date of the claim Event will determine which

insurance benets you have. If your new American Express card comes

with insurance benets, you may be entitled to cover under that new policy.

You should always check before changing to another American Express

card whether that card comes with insurance benets, and the terms and

conditions associated with any such insurance benets to ensure the level

of cover is right for You.

If your American Express Card Account is suspended or cancelled, then

there is no cover under this Policy.

Please see the table below for more information.

10

THE AMERICAN EXPRESS PLATINUM CARD

Example A – No American Express Card Account in place at the date of

claim Event

Example B – Dierent American Express card in place at the date of

claim Event

Joan holds an American Express Card Account that has travel insurance

cover and makes a Qualifying Travel Purchase for a Trip that she intends to

take later in the year.

Before she starts her Trip, Joan decides to cancel her American Express Card

Account. Upon cancelling her American Express Card Account, Joan does

not apply for another American Express card.

Subsequently, Joan travels and unfortunately her luggage is lost in transit to

her scheduled destination.

Joan does not have any entitlement to make a claim under the Policy for

the lost luggage as Joan had cancelled the American Express Card Account,

which means Joan did not hold a valid American Express Card Account at

the date of the claim Event and therefore no longer has access to the travel

insurance cover.

Tim makes a Qualifying Travel Purchase for a Trip using his American Express

Card Account that has travel insurance cover.

Prior to travelling, Tim arranges with American Express to downgrade his

card to another American Express card with a lower fee that has less travel

insurance benets.

On the Trip, Tim suers an Injury. The previous American Express Card

Account which Tim held included Medical Emergency Expenses cover, but

the new card held by Tim at the date of the claim Event does not include

Medical Emergency Expenses cover.

Tim cannot therefore make a claim for Medical Emergency Expenses as

the policy in-force at the date of the claim Event does not include this type

of cover.

For medical and travel emergencies, or for Assistance Services (Legal Assistance, Roadside Assistance or Home Assistance), please contact Chubb

Assistance on +61 2 8907 5666.

For claims and general enquiries about this Policy, please contact Chubb:

Address: Grosvenor Place, Level 38, 225 George Street, SYDNEY NSW 2000 Australia

Postal Address: GPO Box 4907, SYDNEY NSW 2001

Telephone: 1800 236 023

Overseas Telephone: +61 2 9335 3492

Email: CardmemberServices.ANZ@Chubb.com

Not an emergency?

Making a claim is quick and easy. You can submit Your claim online by visiting the Chubb Claims Centre for American Express:

www.americanexpress.com/australia/claims

The following examples are provided to illustrate how Your cover may be aected by changes to Your card.

THE AMERICAN EXPRESS PLATINUM CARD

11

Coverage Summary

IMPORTANT

• The following table is a summary of cover only, it is not an exhaustive list of all limits, terms, conditions or exclusions in this Policy. It is intended to be a quick

reference tool to help You understand the main benets and some exclusions that apply.

• You should always read the full Policy for comprehensive details.

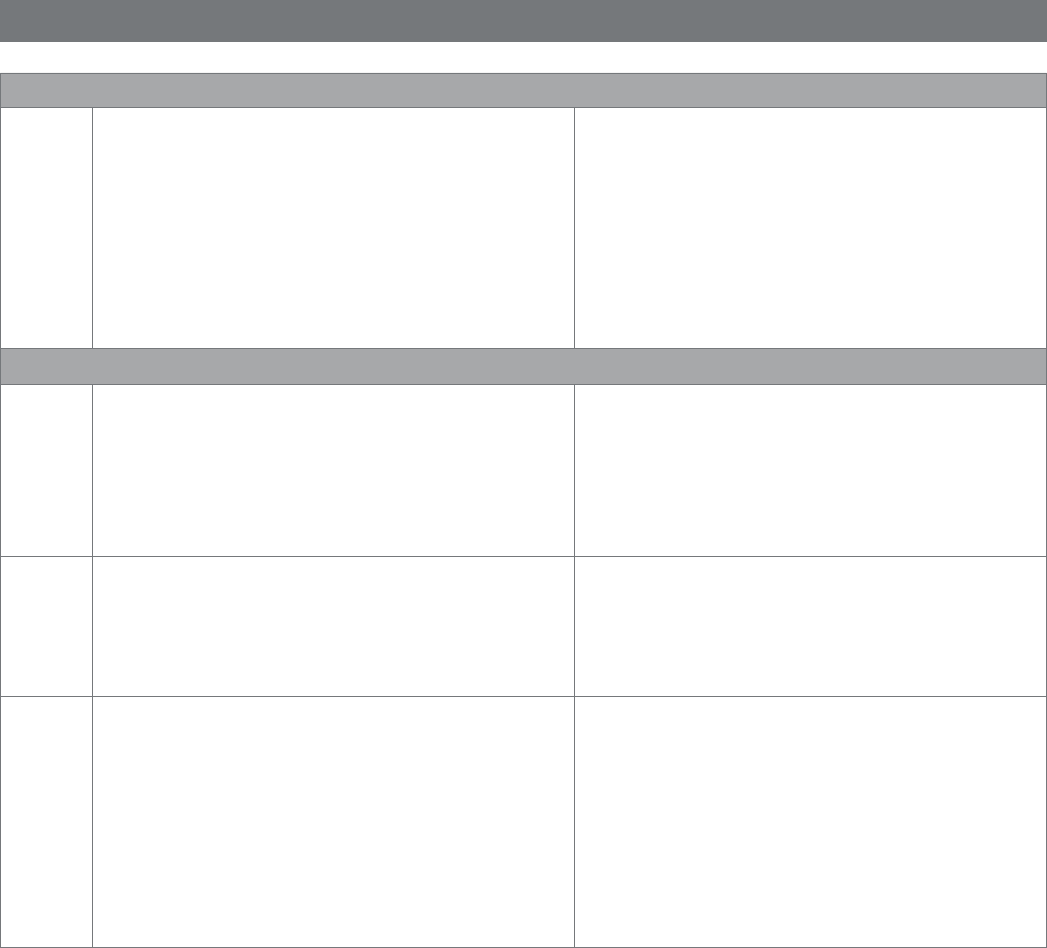

Section Cover Description Key Exclusions

Travel Insurance Cover

A Trip Cancellation and Amendment Cover

Provides cover in the event You must Cancel, Curtail or change Your Trip

for the following reasons:

• You or Your Travelling Companion suering an Injury, unforeseen

Illness or dying before or during Your Trip;

• A Close Relative, suering an Injury or an unforeseen Illness or

dying before or during Your Trip;

• a Natural Disaster has caused devastation to the destination You

were intending to travel;

• an Australian State or Territory or the Australian Federal

Government or an Australian government agency (such as DFAT

– Department of Trade and Foreign Aairs) upgrading a travel

advisory to ‘Reconsider your need to travel’ or ‘Do Not Travel’

travel warning or borders closing in respect of the destination You

were intending to travel after You:

- make Your Qualifying Travel Purchase in the case of a

Cancellation claim, or

- start Your Trip in the case of a Curtailment or Trip Change.

Cover varies depending on the Trip type (international or domestic).

What is covered?

Non-refundable deposits, excursion costs and unused travel and

accommodation costs You have paid in advance.

We will not pay for:

• Cancellation, Curtailment or Trip Change due to a Pre-Existing

Medical Condition;

• losses arising from the death, serious injury or acute Illness of

any Close Relative or Travelling Companion who is 91 years or

older when You made Your Qualifying Travel Purchase;

• circumstances where Cancellation, Curtailment or Trip Change

was foreseeable, avoidable, unnecessary or within Your

control at the time of making a Qualifying Travel Purchase (for

Cancellation) or before starting a Trip (for Curtailment or

Trip Change);

• You or any other person simply changing their mind and

deciding not to travel or choosing to stop their Trip;

• Cancellation, Curtailment or Trip Change of a Domestic

Return Trip due to border closures, travel advisory warnings or

quarantine as a result of an epidemic, pandemic or outbreak of

an infectious disease or virus or any derivative or mutation of

such viruses;

• the cancellation or postponement of a Special Event arising

from or related to an epidemic, pandemic or outbreak of an

infectious disease or virus or any derivative or mutation of

such viruses.

B Card Account Balance Waiver Cover

If You suer a Personal Accident (Section C below), pays the

balance owing on Your American Express Card Account at the time

of the accident.

We will not pay for:

• any charges on Your American Express Card Account that are

already more than 90 days overdue at the time of the accident.

C Personal Accident Cover

1. Accidental Death or Permanent Disablement during Your Trip

Cover in the event of Your Accidental Death or Permanent Disablement

due to an accident whilst on a Trip.

2. Public Transport Accident Cover

Provides cover for Accidental Death or Permanent Disablement arising:

• While travelling as a passenger on a Public Transport; or

• From exposure and disappearance.

We will not pay for:

• events which occur whilst travelling on privately hired, rented

or chartered transport under part 2 – Public Transport Accident

Cover;

• death caused by illness or natural causes.

12

THE AMERICAN EXPRESS PLATINUM CARD

D Travel Inconvenience Cover

Provides cover if:

• Your Scheduled Flight departure is delayed by 4 hours or more;

• Your Scheduled Flight is cancelled;

• You are denied Scheduled Flight boarding;

• You miss a Scheduled Flight connection; or

• Your checked luggage is delayed by 6 hours or more.

The amount of cover varies for each benet.

We will not pay for:

• Personal Baggage delay at the airport You rst departed from in

Your Home State or Territory in Australia;

• the purchase of clothing and toiletries which are not necessary

for Your Trip;

• costs if You fail to notify the transport provider or carrier about

delayed or missing luggage or You do not obtain a luggage

incident report from them or show You have taken reasonable

steps to obtain one.

E Medical Emergency Expenses Cover

Provides cover for Repatriation/Evacuation, cost of overseas Treatment,

emergency dental Treatment and reasonable extra accommodation

costs in the event of a Medical Emergency while You are on Your

International Return Trip, and transportation of Your remains or burial

expenses following Your death while on a Trip.

We will not pay for:

• costs relating to Pre-Existing Medical Conditions;

• any expenses if you are 80 years of age or older before You make

your Qualifying Travel Purchase;

• medical costs if You do not make reasonable attempts to

contact Chubb Assistance where You were reasonably able to

do so;

• costs arising from Your participation in Excluded Sports and

Activities (for example, horse riding, deep sea shing, bungee

jumping, jet skiing, hot air ballooning and rock climbing). Check

the denition of Excluded Sports and Activities in the Denitions

section for the full list of excluded activities;

• costs arising from or related to Trips where the following advice

has been provided prior to starting Your Trip,

- an Australian State or Territory or the Australian Federal

Government or an Australian government agency (such as

DFAT) has issued a travel advisory warning, advising You to

‘Do Not Travel’ or that borders are closed, for the destination

You planned to travel to; or

- a Doctor advised You not to travel.

F Resumption of Long International Trip Cover

Covers the costs of resuming Your Long International Trip (of 2 weeks

or more) if it is interrupted due to the death, imminent death, Injury or

unforeseen Illness of a Close Relative.

We will not pay for:

• costs arising from or relating to interruption due to the death,

Injury or unforeseen Illness of a Close Relative who is 91 years of

age or older before You make Your Qualifying Travel Purchase;

• death, accident or Illness of a Close Relative where such an

event was reasonably foreseeable at the time of making Your

Qualifying Travel Purchase;

• costs arising from the Terminal Illness of a Close Relative which

was diagnosed before You made Your Qualifying Travel Purchase;

• an interruption to a Long International Trip which was caused

by or was related to an epidemic, pandemic or outbreak of an

infectious disease or virus or any derivative or mutation of

such viruses.

THE AMERICAN EXPRESS PLATINUM CARD

13

G Personal Baggage, Valuables, Money and Travel Documents Cover

Provides cover if Your Personal Baggage, Valuables, Money and Travel

Documents are damaged, destroyed, lost or stolen during Your Trip.

We will not pay for:

• Valuables or Money within Your Personal Baggage checked in or

stowed in the luggage hold of an airplane, ship, bus or train;

• Valuables and/or Money that are left Unattended in a motor

vehicle (unless You have no option other than to leave the items

Unattended due to an emergency medical, security or

evacuation situation);

• any Items left Unattended in a Public Place (unless You have

no option other than to leave the items Unattended due to an

emergency medical, security or evacuation situation);

• claims where You do not obtain a report from local police, the

carrier, tour or transport operator or accommodation provider and

You have not taken reasonable steps to obtain one either.

H Personal Liability Cover

Covers Your liability if You damage someone’s property or cause

them injury.

We will not pay for:

• You intentionally incurring any liability;

• injury You cause to any person who is a member of Your family,

a Close Relative, or any person under a contract of service or

apprenticeship with You;

• injury or damage involving:

a) mechanically propelled vehicles (including scooters), aircraft

(including drones), hovercraft or watercraft (other than

non-mechanically propelled watercraft less than 10 metres in

length);

b) rearms; or

c) animals (other than horses and domestic pets).

I Loss of Income Cover

Covers loss of employment income if You suer an Illness or Injury

during the course of Your Trip which results in Temporary Total

Disablement and a loss of employment income of 30 days or more.

We will not pay for:

• any future income You expect or could receive as part of any bonus

or bonus structure, salary increase, salary sacrice scheme or

employee benet scheme (such as shares);

• Pre-Existing Medical Conditions.

J Hijack Cover

If Your Public Transport is Hijacked and You are detained for more than

24 hours, covers the cost of Your Close Relatives travelling to stay at the

place of Your Hijack.

We will not:

• act as Your negotiator or intermediary or advise You in dealing with

the Hijackers.

K Kidnap Cover

If You are Kidnapped, covers the cost of Your Close Relatives travelling to

stay at the place of the Kidnap.

We will not:

• act as Your negotiator or intermediary or advise You in dealing with

the Kidnappers.

14

THE AMERICAN EXPRESS PLATINUM CARD

Loss Damage Waiver Cover

L Loss Damage Waiver Cover

Covers loss or damage to a Rental Vehicle.

We will not pay for:

• any costs arising from driving by persons who do not have a

valid driving licence or are not a nominated or specied driver

under the Rental Agreement;

• anyone under the age of 21 or over the age of 79 years of age

before You make Your Qualifying Rental Vehicle Purchase;

• The rental of trailers or caravans, vehicles for business or

commercial use, motorcycles, mopeds, campervans and

motor homes;

• Rental Vehicles which are hired for longer than 31 days;

• Rental Vehicles with a retail purchase price in excess of

$125,000.

Retail Item Protection

M Card Purchase Cover

Covers theft or damage to Eligible Items within 90 days of purchase.

We will not pay for:

• Eligible Items left Unattended in a Public Place (unless You have

no option other than to leave the Eligible Items Unattended due

to an emergency medical, security or evacuation situation);

• Eligible Items left in an Unattended motor vehicle except where

they are locked out of sight in a Secure Area which has been

accessed by Forcible Entry or You have no option other than

to leave the Eligible Items Unattended due to an emergency

medical, security or evacuation situation.

N Card Refund Cover

Covers You for a refund of the purchase price on any unused Eligible

Items that You wish to return which the retailer operating in Australia

will not take it back (for up to 90 days after purchase).

We will not pay for:

• Eligible Items returned because they are faulty;

• claims where a store credit or credit note has been oered;

• items purchased from a retailer outside Australia;

• Eligible Items with a purchase price of $50 or less;

• used or second-hand items.

O Buyer's Advantage Cover

Provides cover for the breakdown or defect of Eligible Items beyond the

expiry of the original manufacturer’s warranty period (applicable within

Australia), as follows:

i. if the original manufacturer’s warranty period is 1 year or less,

buyer's advantage extends cover by the same period as the

Original Warranty (for example, if the Original Warranty is 1 year

the buyer's advantage cover period will be an additional 1 year);

ii. if the original manufacturer’s warranty period expires between

2- 5 years, the buyer's advantage extends cover for a period of 1

year (for example, if the Original Warranty is 3 years, the buyer's

advantage cover period will be an additional 1 year).

(Please refer to the cover section for more details).

We will not pay for:

• items purchased from a retailer outside Australia;

• any costs other than for parts and/or labour costs resulting

from a covered breakdown or defect.

THE AMERICAN EXPRESS PLATINUM CARD

15

P Smartphone Screen Cover

Provides cover for breakage to the front screen of Your Smartphone

following accidental drop or impact.

We will not pay for:

• any replacement of any other parts of the Smartphone, other

than for the glass or plastic front screen;

• if You have not paid for Your Smartphone Data Plan on Your

American Express Card Account for the 3 consecutive months

immediately prior to breakage of the front screen of Your

Smartphone (unless You have purchased the Smartphone

outright in 1 single transaction);

• damage to Smartphones older than 3 years of age.

Assistance Services

Q Legal Assistance

Provides cover for referral to a local lawyer and advance of emergency

legal fees and bail bond whilst on an International Return Trip.

This cover section is available whilst on an International Return Trip only.

We will not pay for:

• legal assistance requested within Australia;

• legal fees or bail bond exceeding $10,000.

R Roadside Assistance

Provides cover in respect of Covered Vehicles for Roadside Assistance

or towing, replacement vehicles or return of vehicles.

This cover section is available within Tasmania and mainland

Australia only.

We will not pay for:

• claims arising from participation in motor racing, rallies, speed

or duration tests;

• claims arising as a result of the car not being adequately

repaired, serviced or not maintained in accordance with

manufacturer’s recommendation;

• claims arising if the vehicle has been used for hire or reward, or

carriage of commercial goods;

• loss or damage deliberately caused by You.

S Home Assistance

Provides cover for:

a. 24-hour referral to service providers, such as plumbers or

locksmiths; and

b. charges for 2 Emergency call-outs per year.

This cover section is available within Tasmania and mainland

Australia only.

We will not pay for:

• any charges related to labour and spare parts;

• call-out costs for non-Emergency call outs.

16

THE AMERICAN EXPRESS PLATINUM CARD

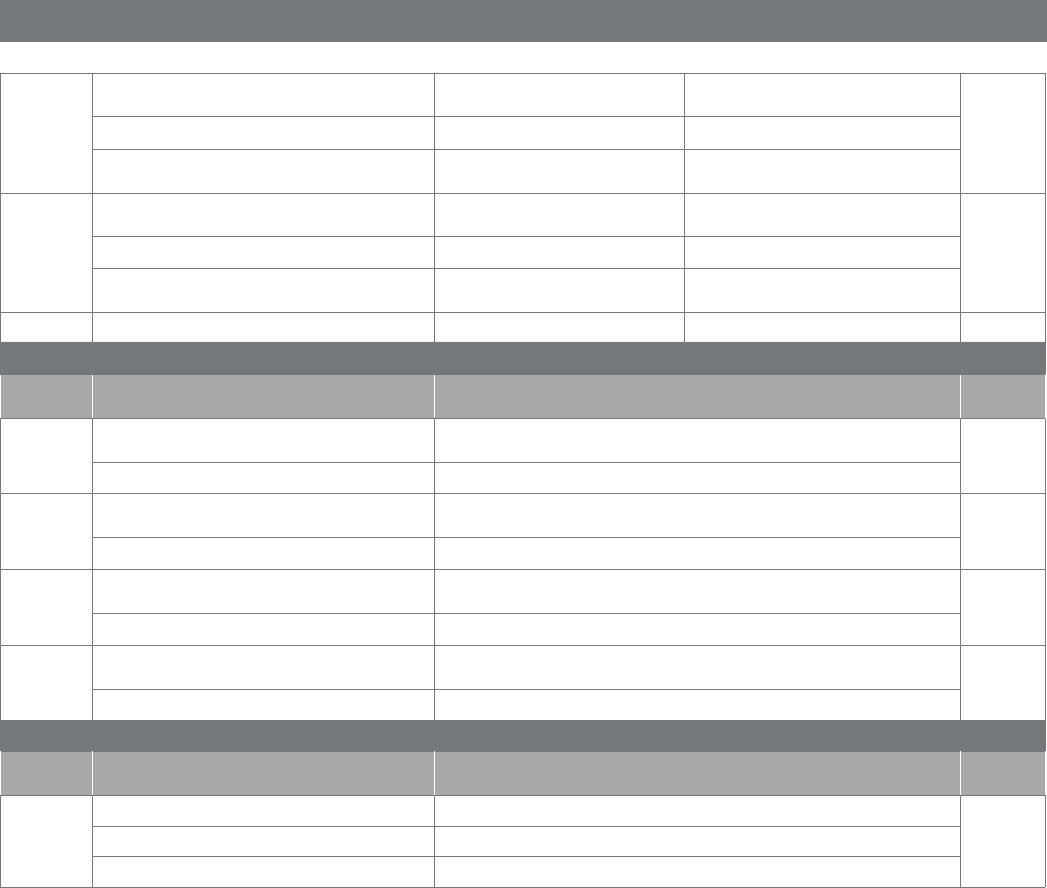

Schedule of Benets

Please note that amounts quoted are in Australian dollars (unless otherwise stated).

Travel Insurance

Section of

Cover

Cover Description Benet Limit – per Covered Person unless otherwise stated Excess

Applies

International Return Trip Domestic Return Trip

Section A

Trip Cancellation and Amendment Cover

(section limit)

Up to $30,000 Up to $30,000

$250

b. Travel agent commission (sub limit) Up to $750 or 15% of the total

booking amount, whichever is the

lesser

Up to $750 or 15% of the total booking

amount, whichever is the lesser

c. Additional travel and accommodation

(sub limit)

Up to $5,000 Up to $5,000

Section B Card Account Balance Waiver

The total amount owing on Your

American Express

Card Account

The total amount owing on Your

American Express Card Account

NIL

Section C

Personal Accident Cover Card Member/Additional Card

Member/Spouse/

Dependent Child(ren)

Card Member/Additional Card

Member/Spouse/

Dependent Child(ren)

NIL

1. Accidental Death

or Permanent

Disablement

arising during Your

Trip

Benet Type

i. Accidental Death $50,000 $50,000

Permanent

Disablement:

ii. Loss of both hands

or both feet

$50,000 $50,000

iii. Loss of one (1) hand

and one (1) foot

$50,000 $50,000

iv. Loss of entire sight

of both eyes

$50,000 $50,000

v. Loss of entire sight

of one (1) eye and

loss of one (1) hand

or one (1) foot

$50,000 $50,000

vi. Loss of one (1) hand

or one (1) foot

$25,000 $25,000

vii. Loss of the entire

sight of one (1) eye

$25,000 $25,000

THE AMERICAN EXPRESS PLATINUM CARD

17

2. Public Transport

Accident Cover

Benet Type Card Member/Additional Card

Member/Spouse/

Dependent Child(ren)

Card Member/Additional Card

Member/Spouse/

Dependent Child(ren)

NIL

a. Accidental Death

or Permanent

Disablement arising

while travelling as

passenger on Public

Transport

b. Accidental Death

or Permanent

Disablement arising

from exposure

c. Accidental Death

arising from

disappearance while

travelling on Public

Transport

i. Accidental Death

$400,000 $400,000

Permanent

Disablement:

ii. Loss of both hands

or both feet

$400,000 $400,000

iii. Loss of one (1) hand

and one (1) foot

$400,000 $400,000

iv. Loss of entire sight

of both eyes

$400,000 $400,000

v. Loss of entire sight

of one (1) eye and

loss of one (1) hand

or one (1) foot

$400,000 $400,000

vi. Loss of one (1) hand

or one (1) foot

$200,000 $200,000

vii. Loss of the entire

sight of one (1) eye

$200,000 $200,000

Section D

Travel Inconvenience Cover Per Covered

Person

Maximum for

all Covered

Persons (when

travelling

together)

Per Covered

Person

Maximum for all

Covered Persons

(when travelling

together)

NIL

1. Delayed, cancelled, overbooked or missed

onward Scheduled Flight

Up to $700

after 4 hours

Up to $1,400

after 4 hours

Up to $700 after

4 hours

Up to $1,400 after

4 hours

2. Extended Delayed, cancelled, overbooked or

missed onward Scheduled Flight

Up to $500 per

24-hour period

to a maximum

of $2,000

Up to $1,000 per

24-hour period

to a maximum of

$4,000

Up to $500 per

24-hour period

to a maximum of

$2,000

Up to $1,000 per

24-hour period

to a maximum of

$4,000

3. Delay of Personal Baggage checked-in on

Scheduled Flight

Up to $700

after 6 hours

Up to $1,400

after 6 hours

Up to $700 after

6 hours

Up to $1,400 after

6 hours

4. Extended Delay of Personal Baggage checked-in

on Scheduled Flight

Up to $700

after 48 hours

Up to

$1,400 after

48 hours

Up to

$700 after

48 hours

Up to

$1,400 after

48 hours

5. Delayed arrival to a Special Event Up to $3,000 Up to $6,000 Up to $3,000 Up to $6,000

18

THE AMERICAN EXPRESS PLATINUM CARD

Section E

Medical Emergency Expenses Cover

1. In The Event Of A Medical Emergency

(section limit)

Unlimited

Not Covered $250

1.a. In The Event Of A Medical Emergency &

Repatriation/Evacuation (sub limit) –

costs arising as a result of Terrorism

Up to $1,000,000

2. Emergency Dental (sub limit) Up to $1,500

3. Repatriation/Evacuation (sub limit) Unlimited

4. Incidental expenses each 24 hours (sub limit) Up to $75 per 24-hour period

to a maximum of $5,000

5. Extra accommodation (room only) (sub limit) Up to $250 per 24-hour period up

to a maximum of $2,500

6. a) Return economy airfare (sub limit) Up to $5,000

6. b) Extra accommodation (room only) Up to $250 per 24-hour period up

to a maximum of $2,500

2. In The Event Of Your death (Repatriation/

Funeral/Burial Costs)

Up to $15,000 Up to $15,000

NIL

In the event of Your death in a Schengen

member state

Up to 30,000 EUR Not Covered

Section F

Resumption Of Long International Trip Cover

$250

1) Returning to Australia for a Close Relative Up to $5,000 Not Covered

Section G

Personal Baggage, Valuables, Money And Travel

Documents Cover (section limit)

Up to $30,000 Up to $30,000

$250

a. Money and Travel Documents (sub limit) Up to $1,000 Up to $1,000

b. Maximum total of all Valuables (including

sub limits i. to iv.);

Up to $9,000 Up to $9,000

i. One (1) Smartphone (sub limit); Up to $1,000 Up to $1,000

ii. One (1) laptop (including accessories sold with

the laptop) (sub limit);

Up to $3,000 Up to $3,000

iii. One (1) camera (including lenses and

accessories) (sub limit);

Up to $5,000 Up to $5,000

iv. Any other Valuable item (sub-limit) Up to $5,000 Up to $5,000

c. any other single item or Pair or Set of items

(sub limit);

Up to $5,000 Up to $5,000

Section H Personal Liability Cover

Up to $3,000,000 Up to $3,000,000

NIL

Section I

Loss Of Income Cover (section limit) Up to $15,000 Up to $15,000

30 Days

Monthly Salary (up to 5 months) Up to $3,000 per month Up to $3,000 per month

THE AMERICAN EXPRESS PLATINUM CARD

19

Section J

Hijack Cover (section limit is an aggregate limit

for all Your Close Relatives)

Up to $29,000 Up to $29,000

NIL

a. return economy airfare Up to $5,000 Up to $5,000

b. Extra accommodation (room-only) for each

twenty-four (24) hour period

Up to $2,000 per 24-hour period

to a maximum of $24,000

Up to $2,000 per 24-hour period

to a maximum of $24,000

Section K

Kidnap Cover (section limit is an aggregate

limit for all Your Close Relatives)

Up to $29,000 Up to $29,000

NIL

a) return economy airfare Up to $5,000 Up to $5,000

b) Extra accommodation (room-only) for each

twenty-four (24) hour period

Up to $2,000 per 24-hour period

to a maximum of $24,000

Up to $2,000 per 24-hour period

to a maximum of $24,000

Section L

Loss Damage Waiver Cover Up to $125,000 Up to $125,000

NIL

Retail Item Protection

Section of

Cover

Cover Description Benet Limit Excess

Applies

Section M

Card Purchase Cover (section limit) Up to $30,000 in any three hundred and sixty-ve (365) day period beginning

when the rst claim Event occurs

$50

Per Eligible Item Up to $3,500

Section N

Card Refund Cover (section limit) Up to $5,000 in any three hundred and sixty-ve (365) day period beginning

when the rst claim Event occurs

NIL

Per Eligible Item Up to $1,000

Section O

Buyer's Advantage Cover (section limit) Up to $20,000 in any three hundred and sixty-ve (365) day period beginning

when the rst claim Event occurs

NIL

Per Eligible Item Up to $20,000

Section P

Smartphone Screen Cover (section limit) two (2) eligible claims in any three hundred and sixty-ve (365) day beginning

when the rst claim Event occurs

10% of

the repair

cost

Per Smartphone Up to $500

Assistance Service

Section of

Cover

Cover Description Benet Limit Excess

Applies

Section Q

Legal Assistance

NIL

1. Referrals and Advance of Lawyer’s Fees Up to $10,000

2. Advance of Bail Bond Up to $10,000

20

THE AMERICAN EXPRESS PLATINUM CARD

Section R

Roadside Assistance

NIL

1. Roadside Assistance Up to $200

2. Replacement Vehicle Rented vehicle costs for up to 3 consecutive days

3. Return of You and Passenger/s to Your Home Up to $400 or 400 kilometres, whichever is less

4. Return or Collection of Vehicle after Repair Transportation costs to collect a Covered Vehicle

Section S Home Assistance

Two (2) eligible claims in any three hundred and sixty-ve (365) day beginning

when the rst claim Event occurs

NIL

Denitions

The following words when used with capital letters in this document have

the meaning given below. Wherever these words are used in plural in this

Policy, they have the same meaning as the singular form shown below.

Accidental Death means death occurring as a result of an Injury.

American Express means American Express Australia Limited (ABN

92 108 952 085, AFS Licence No. 291313) of 12 Shelley Street, Sydney NSW

2000, the Group Policy holder.

American Express Card Account means an account issued by American

Express Australia Limited which is current (meaning it is not suspended or

cancelled), billed from Australia and in Australian dollars for the following

card product:

(a) American Express Platinum Card.

Additional Card Member means a person who is issued an additional

American Express card that is connected to the Card Member’s

primary American Express Card Account (also known as a supplementary

Card Member).

Appointed Claims Handler means Chubb or its claims handling agent

and/or representative.

Card Member means a person who is issued an American Express Card

Account as the primary account holder.

Chubb means Chubb Insurance Australia Limited (ABN 23 001 642 020,

AFS Licence No. 239687) of Grosvenor Place, Level 38, 225 George

Street, Sydney NSW 2000, the insurer of the Group Policy held by

American Express.

Chubb Assistance means the service provider acting on behalf of Chubb

to provide emergency assistance.

Close Relative means Spouse, parent, parent-in-law, step-parent, child,

brother, half-brother, step-brother, brother-in-law, sister, half-sister, step-

sister, sister-in-law, daughter-in-law, son-in-law, niece, nephew, uncle, aunt,

grandparent or grandchild.

Covered Person means the Card Member or an Additional Card Member,

and:

1. their Spouse;

2. their Dependent Child(ren)

who meets the eligibility criteria as specied in the Eligibility Table.

Dependent Child(ren) means any child (including stepchild or adopted

child) of a Card Member, Additional Card Member or Spouse who is

primarily dependent upon the Card Member or Spouse for maintenance

and support, and who is:

a) 25 years of age or younger; or

b) of any age permanently mentally or physically incapable of self-

support, as conrmed by medical evidence from a Doctor and who is

permanently living with the Card Member or Spouse.

Dentist means a legally registered dentist who is not You or Your

Close Relative.

Doctor means a legally registered medical practitioner who is not You or

Your Close Relative.

Domestic Return Trip means a return trip within Australia that is more

than 150 kilometre radius from Your Home:

starting:

a) when You leave Your Home or Your Work (whichever occurs last) to

travel to Your destination, or

b) when You leave Your Home or Your Work (whichever occurs last) to

travel to the departure point of Your Scheduled Flight or Scheduled

Cruise; and

ending:

c) when You return to Your Home or Your Work (whichever occurs

rst); or

d) when Your trip exceeds 180 consecutive days.

Eligible Item means an item:

1. that is purchased from a retailer solely for personal use; and

2. that is new and has not been used in any way at the time of

purchase; and

3. the cost of which has been charged to Your American Express Card

Account (including through the redemption of American Express

Membership Rewards points).

THE AMERICAN EXPRESS PLATINUM CARD

21

Event(s) means an occurrence that gives rise to a claim for a benet under

Your Policy. Multiple occurrences attributable to one source or originating

cause is deemed to be one Event.

Excess is the amount You must pay for each successful claim where

indicated.

Excluded Sports and Activities means boxing; cave diving; horse

jumping; horse riding; hunting and hunting on horseback; professional

sports; canyoning; caving; diving; mountain-climbing; steeple chasing; any

form of motor racing; speed, performance or endurance tests; abseiling;

American football; bob sleigh; bungee jumping; base jumping; canoeing;

clay pigeon shooting; deep sea shing; go-karting; hang gliding; heli-

skiing; hot air ballooning; ice hockey; jet biking and jet skiing; martial arts;

micro-lighting; mountain biking o tarmac; mountaineering; parachuting;

paragliding; parascending; paraskiing; polo; quad biking; rock climbing;

SCUBA diving deeper than 30 metres; skidoo; ski-jumping; ski-racing;

ski-stunting; tour operator safari (where You or any tourist will be carrying

guns); trekking requiring climbing equipment and/or ascending above

3,000 metres from sea level; war games/paint ball; white water rafting;

yachting more than 20 nautical miles from the nearest coastline.

Forcible Entry means unlawful entry by forcible and violent means, as

evidenced by a broken window, damaged or picked lock, broken hinge or

door handle.

Group Policy means the group policy of insurance held by American

Express as detailed in the 'General Information To Know About This

Policy' section of this Policy.

Hijack means the unlawful seizure of or wrongful exercise of control of the

aircraft or other Public Transport on which You are travelling. Hijacking,

Hijacked and Hijackers have the same corresponding meaning.

Home means Your usual place of residence in Australia (where You live).

Illness means a sickness or disease which requires treatment by a Doctor

or a Dentist; it does not include an Injury or Pre-Existing

Medical Conditions.

Injury means an accidental bodily injury resulting solely and directly from:

1. a sudden, external and identiable Event that happens by chance and

could not have been expected from the perspective of the Covered

Person; and

2. which occurs independently of any Illness or any other cause, and

3. causes a loss within 12 months of the accident.

It does not include an Illness or a Pre-Existing Medical Condition.

Insolvency means bankruptcy, provisional liquidation, liquidation,

insolvency, appointment of a receiver or administrator, entry into a scheme

of arrangement, statutory protection stopping the payment of debts or

the happening of anything of a similar nature under the applicable laws of

any jurisdiction.

International Return Trip means a trip where Your destination is outside

of Australia:

starting:

(a) when You leave Your Home or Your Work (whichever occurs last) to

travel to the airport to y on Your Scheduled Flight; or

(b) when You leave Your Home or Your Work (whichever occurs last) to

travel to a harbour port to board a Scheduled Cruise; and

ending:

(c) when You return to Your Home or Your Work (whichever occurs rst)

having travelled from the airport or harbour port; or

(d) when Your trip exceeds 180 consecutive days.

Kidnap means the illegal taking, seizing or detaining by force and holding

of You in captivity for the purpose of demanding payment of monies to

secure Your release. Kidnapping, Kidnapped and Kidnappers have the

same corresponding meaning.

Long International Trip means an International Return Trip with an

itinerary of 15 days or more.

Manual Work means paid work which involves the installation, assembly,

maintenance or repair of electrical, mechanical or hydraulic plant (other

than in a purely managerial, supervisory, sales or administrative capacity).

It also means manual labour of any kind including, but not restricted to,

hands-on work such as a plumber, electrician, lighting or sound technician,

carpenter, painter, decorator or builder.

Medical Emergency means:

• an Injury;

• sudden and unforeseen Illness; or

• a dental issue,

suered by You while overseas on an International Return Trip, which

results in the immediate need for Treatment which cannot be reasonably

delayed until Your return to Australia without causing discomfort or risk

of aggravation in the opinion of a local treating Doctor or by

Chubb Assistance.

Money means currency, travellers cheques, hotel and other redeemable

holiday vouchers and petrol coupons. It does not mean cryptocurrency.

Monthly Salary means:

1. for an employed person: all items of remuneration including

pre-tax salary, bonuses, commission and the like paid every

calendar month; or

2. for a self-employed person: monthly pre-tax income derived from

personal exertion, after deduction of all expenses incurred in

connection with the derivation of that income, averaged over the

period of twelve (12) months immediately preceding the loss of

income or over such shorter period as they have been self-employed.

Natural Disaster means volcanic eruption, ood (more than 20,000

square metres of normally dry land), tsunami, earthquake, landslide,

cyclone, tornado or bushre. The term Natural Disaster does not include

any infectious or contagious disease or virus regardless of transmission

(including pandemic or epidemic).

One-Way Trip means any trip for which You are unable to provide evidence

of Your intention to return to Your Home or Your Work.

22

THE AMERICAN EXPRESS PLATINUM CARD

Pair or Set means two or more items that are: i) used together; ii)

associated with each other; or iii) corresponding (including attached and

unattached accessories) and regarded as 1 unit.

Permanent Disablement means a loss caused by an Injury which results

in the:

i. complete and permanent severance of a foot at or above the ankle

joint; or

ii. complete and permanent severance of a hand at or above the wrist; or

iii. irrecoverable loss of the entire sight of an eye.

Personal Baggage means items of necessity, ornament or personal

convenience for Your individual use during the Trip, including clothing,

toiletries, and personal eects worn or carried by You within a suitcase (or

similar). It does not include Valuables.

Policy means this document which details the insurance benets available

to You under the Group Policy including all relevant terms, benet limits,

conditions and exclusions.

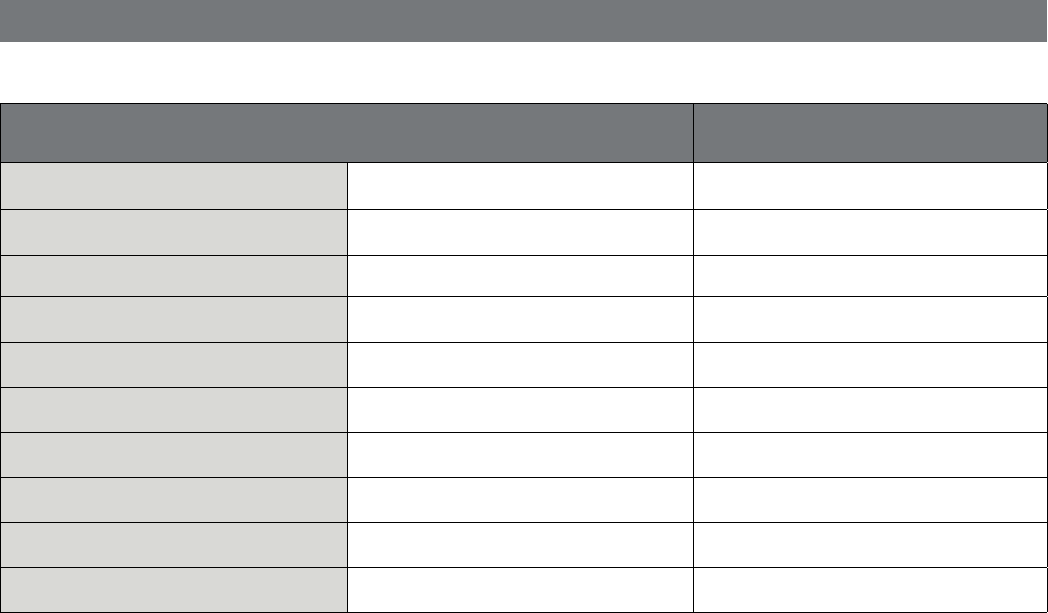

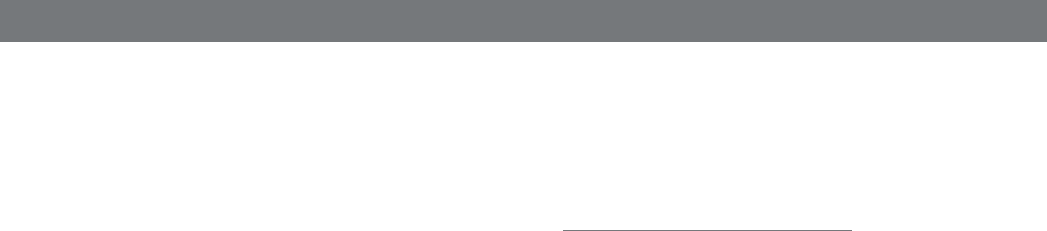

IN THE TIME PERIOD

PRIOR TO MAKING

YOUR QUALIFYING

TRAVEL PURCHASE

THE PHYSICAL DEFECT, MEDICAL OR DENTAL CONDITION, ILLNESS, INJURY OR DISEASE

2 years requires either of the following:

1.

i. ongoing medication for treatment or risk factor control;

ii. prescribed medication from a Doctor;

iii. check-ups, consultations, reviews or progress advice (other than those recommended by a Doctor to review a

previous condition that is considered by a Doctor prior to You making Your Qualifying Travel Purchase to be cured or in

complete remission); or

iv. surgery;

or

2. is either

i. under investigation;

ii. pending diagnosis or test results; or

iii. chronic or arthritic.

3 years THE PHYSICAL DEFECT, MEDICAL OR DENTAL CONDITION, ILLNESS, INJURY OR DISEASE

aects any of the following body parts:

• heart;

• brain (other than a mental health–related condition);

• liver;

• back/spine;

• kidneys;

• cardiovascular or circulatory or respiratory system;

and

where such medical condition either:

I. involved a hospital emergency visitation or being an inpatient in hospital; or

II. required or requires surgery, a specialist appointment or consultation; or

III. requires:

i. ongoing medication for treatment or risk factor control; or

ii. prescribed medication from a Doctor; or

iii. check-ups, consultations, reviews or progress advice (other than those recommended by a Doctor to review a

previous condition that is considered by a Doctor prior to You making Your Qualifying Travel Purchase to be cured

or in complete remission); or

a) is currently either:

i. under investigation; or

ii. pending diagnosis or test results.

Pre-Existing Medical Condition means any physical defect, medical or dental condition, illness, injury or disease that:

THE AMERICAN EXPRESS PLATINUM CARD

23

5 years THE PHYSICAL DEFECT, MEDICAL OR DENTAL CONDITION, ILLNESS, INJURY OR DISEASE related to cancer.

3 Months

THE PHYSICAL DEFECT, MEDICAL OR DENTAL CONDITION, ILLNESS, INJURY OR DISEASE led to the manifestation of

symptoms where a reasonable person in the circumstances would be expected to be aware of or a reasonable person under

the circumstances would have foreseen.

Public Place means any place that is accessible by the public, including,