SUPPLEMENTAL TRIP CANCELLATION &

TRIP INTERRUPTION INSURANCE PLAN

CERTIFICATE OF INSURANCE

AMEX

®

TRAVEL INSURANCE

INTRODUCTION

Supplemental Trip Cancellation & Trip Interruption Insurance for AMEX Cardmembers and insured persons.

THIS COVERAGE IS SUPPLEMENTAL TO THE TRIP CANCELLATION & TRIP INTERRUPTION COVERAGE PROVIDED

ON THE CARDMEMBER’S AMEX CARD.

IMPORTANT – PLEASE READ: This Certicate of Insurance is a valuable source of information and contains provisions that may

limit or exclude coverage. Please read this Certicate of Insurance, keep it in a safe place and carry it with you when you travel.

Amex Bank of Canada has been issued group insurance policy PSI047402221 for Supplemental Trip Cancellation & Trip

Interruption Insurance coverage by Royal & Sun Alliance Insurance Company of Canada (the “Insurer”) to protect your travel

investment prior to departure and cover certain other expenses incurred by you while outside your Canadian province or

territory of residence. This Certicate of Insurance summarizes the provisions of the group insurance policy applicable to your

AMEX Travel Insurance – Supplemental Trip Cancellation & Trip Interruption Plan.

RIGHT TO EXAMINE INSURANCE

You have the right to cancel this Certicate of Insurance within 10 days of receipt and receive a full refund. Upon such request,

this Certicate of Insurance will be considered to never have been in effect and the Insurer will have no liability under this

insurance. You must notify us immediately if you wish to cancel your coverage and written conrmation must be received within

10 days of receipt of the Certicate of Insurance. If your Certicate of Insurance was mailed to you, you have a maximum period

of 15 days from the date the Certicate of Insurance was posted.

All italicized terms have the specic meaning explained in the “Denitions” section of this Certicate of Insurance.

IMPORTANT NOTICE – PLEASE READ CAREFULLY

• Travel insurance is designed to cover losses arising from sudden and unforeseeable circumstances and emergencies.

It is important that you read and understand your Certicate of Insurance before you travel as your coverage may be

subject to certain limitations or exclusions.

• A pre-existing exclusion applies to medical conditions and/or symptoms that existed prior to your trip. Check to see how

this applies in your Certicate of Insurance and how it relates to your departure date, date of purchase, or effective date.

• The basic Cardmember is responsible for this insurance coverage, including coverage bound by any purchases made

by a supplementary Cardmember below the age of majority.

• In the event of an accident, injury or sickness, your prior medical history may be reviewed when a claim is reported.

• For trip cancellation coverage, only the trip costs charged on the Cardmember’s Card will be considered for reimbursement,

up to the benet maximum. Any expenses incurred using other payment sources will not be considered.

• For trip interruption/trip delay coverage, benets are payable to you as long as any portion of the trip costs are charged

to the Cardmember’s Card, up to the benet maximum.

• This Certicate contains clauses which may limit the amounts payable.

• The policy contains a provision removing or restricting the right of the group person insured to designate

persons to whom or for whose benet insurance money is to be payable.

PLEASE READ YOUR CERTIFICATE OF INSURANCE CAREFULLY BEFORE YOU TRAVEL.

WHAT TO DO IN AN EMERGENCY?

If you have an emergency, you can call Global Excel.

Global Excel can be contacted 24 hours a day, 7 days a week by calling:

1-844-780-0501 toll-free from the US & Canada, or +819-780-0501 collect from anywhere in the world.

DEFINITIONS

Throughout this Certicate of Insurance, all italicized

terms have the specic meaning explained below.

Accidental bodily injury

– means bodily injury caused by an

accident of external origin occurring during the period of insurance

and being the direct and independent cause of the loss.

Accommodation – means an establishment providing

commercial accommodations or in the business of operating

a vacation rental marketplace and hospitality service for the

general public.

12 10 CER ECA 0121 TCTI

2

Basic Cardmember – means the person in whose name

Amex Bank of Canada has opened a Card account and does

not include a supplementary Cardmember, provided always

that the basic Cardmember’s Card account privileges have

not expired, been revoked, terminated or suspended.

Business meeting – means a meeting, trade show, training

course, or convention scheduled before your effective date

between companies with unrelated ownership, pertaining to

your full-time occupation or profession and that is the sole

purpose of your trip. Legal proceedings are not considered

to be a business meeting.

Card – means the valid American Express credit or charge

Card issued to you in Canada by Amex Bank of Canada

that has embedded Trip Cancellation & Trip Interruption

Insurance benets at no additional charge (please refer to

your certicate of insurance).

Cardmember – means a holder of a valid Basic or

Supplementary Card issued in Canada by Amex Bank of

Canada.

Caregiver – means the permanent, full-time person entrusted

with the well-being of your dependent(s) and whose absence

cannot reasonably be replaced.

Catastrophic event – means total eligible Cancellation &

Interruption Insurance claims arising directly or indirectly

from an act of terrorism, or series of acts of terrorism,

occurring within a 72-hour period that exceed $1,000,000.

Change in medication – means the addition of any new

prescription drug, the withdrawal of any prescription drug, an

increase in the dose of any prescription drug or a decrease

in the dose of a prescription drug.

Exceptions:

• an adjustment in the dosage of insulin or Coumadin

(Warfarin), if you are currently taking these drugs;

• a change from a brand name drug to an equivalent

generic drug of the same dosage.

Common carrier – means any land, water, or air conveyance

operated under a license for the transportation of passengers

for hire and for which a ticket has been obtained. Common

carrier does not include any conveyance that is hired or used

for a sport, gamesmanship, contest, cruise and/or recreational

activity, regardless of whether such conveyance is licensed.

Rental vehicles are not considered common carriers.

Contamination – means the poisoning of people by nuclear,

chemical and/or biological substances which causes illness

and/or death.

Departure point – means the place from which you depart

your Canadian province or territory of permanent residence on

the rst day, and return to on the last day of your intended trip.

Dependent child(ren) – means an unmarried natural,

adopted, step or foster child of the Cardmember or his or her

spouse who is, on the effective date, at least 15 days old,

dependent on the Cardmember or his or her spouse for

support and:

• is under 21 years of age;

• is a full-time student who is under 25 years of age; or

• has a permanent physical impairment or a permanent

mental disability.

Effective date – means the date and time the required premium

is paid as indicated on your Conrmation of Insurance.

Emergency – means any sudden and unforeseen event that

begins during the period of insurance and makes it necessary

to receive immediate treatment from a licensed physician or

to be hospitalized. An emergency ends when we determine

that you are medically able to return to your departure point.

Global Excel – means Global Excel Management Inc., the

company appointed by the Insurer to provide claims and

assistance services.

Government health insurance plan – means the health

insurance coverage that Canadian provincial and territorial

governments provide for their residents.

Hospital – means an establishment that is licensed as an

accredited hospital, is operated for the care and treatment of

in-patients, has a Registered Nurse always on duty, and has

a laboratory and an operating room on the premises or in

facilities controlled by the establishment. Hospital does not

mean any establishment used mainly as a clinic, extended

or palliative care facility, rehabilitation facility, addiction

treatment centre, convalescent, rest or nursing home, home

for the aged or health spa.

Immediate family – means spouse, parent, legal guardian,

legal ward, step-parent, grandparent, grandchild, in-law,

natural or adopted child, step-child, brother, sister, step-

brother, step-sister, aunt, uncle, niece, nephew.

Insured person – means any of the following persons:

the Cardmember, the Cardmember’s spouse, or the

Cardmember’s dependent child.

Key employee – means an employee whose continued

presence is critical to the ongoing affairs of the business

during your absence.

Medical condition – means accidental bodily injury or

sickness (or a condition related to that accidental bodily

injury or sickness), including disease, acute psychoses

and complications of pregnancy occurring within the rst 31

weeks of pregnancy.

Mountain climbing – means the ascent or descent of

a mountain requiring the use of specialized equipment,

including crampons, pick-axes, anchors, bolts, carabiners

and lead-rope or top-rope anchoring equipment.

Passenger plane – means a certied multi-engined

transportation aircraft provided by a regularly scheduled

airline on any regularly scheduled trip operated between

licensed airports and holding a valid Canadian Air Transport

Board or Charter Air Carrier licence, or its foreign equivalent,

and operated by a certied pilot.

Period of insurance – means the period of time between

your effective date and your return date.

Physician – means someone who is not you or a member

of your immediate family who is licensed to prescribe drugs

and administer medical treatment (within the scope of such

license) at the location where the treatment is provided. A

physician does not include a naturopath, herbalist, chiropractor

or homeopath.

Prescription drugs – means drugs and medicines that can

only be issued upon the prescription of a physician or dentist

and are dispensed by a licensed pharmacist. Prescription

drugs does not mean such drugs or medicine, when you

need (or renew) them to continue to stabilize a condition

which you had before your trip, or a chronic condition.

3

Professional – means engaged in a specied activity as

your main paid occupation.

Return date – means the date on which you are scheduled

to return to your departure point. This date is shown on your

Conrmation of Insurance.

Ridesharing services – mean transportation network

companies in the business of providing peer-to-peer

ridesharing transportation services through digital networks

or other electronic means for the general public.

Spouse – means the person who is legally married to the

Cardmember, or has been living in a conjugal relationship

with the Cardmember for a continuous period of at least one

year and who resides in the same household.

Stable – means any medical condition or related condition

(including any heart condition or any lung condition) for

which there has been:

a) no new treatment, new medical management, or new

prescribed medication; and

b) no change in treatment, change in medical management,

or change in medication; and

c) no new symptom or nding, more frequent symptom or

nding, or more severe symptom or nding experienced;

and

d) no new test results or test results showing a deterioration;

and

e) no investigations or future investigations initiated or

recommended for your symptoms; and

f) no hospitalization or referral to a specialist (made or

recommended).

Supplementary Cardmember – means an authorized user

of the Card account.

Terrorism or Act of terrorism – means an act, including but

not limited to the use of force or violence and/or the threat

thereof, including hijacking or kidnapping, of an individual

or group in order to intimidate or terrorize any government,

group, association or the general public, for religious, political

or ideological reasons or ends, and does not include any

act of war (whether declared or not), act of foreign enemies

or rebellion.

Travel supplier – means a travel agent, a tour operator,

a travel wholesaler, an airline, a cruise line, a provider of

ground transportation, a provider of travel accommodations

who is legally authorized and licensed to sell travel services

to the general public.

Travelling companion – means the person other than

your spouse or dependent child who is sharing travel

arrangements with you to a maximum of three persons.

Trip – means a period of travel outside your Canadian

province or territory of residence for which:

a) There is a departure point and a destination; and

b) There are predetermined and recorded beginning and

ending dates; and

c) Any portion of the prepaid travel arrangements was

charged to the Cardmember’s Card prior to your

departure.

Note: For trip cancellation coverage, only the prepaid

travel arrangements charged to the Cardmember’s Card

will be considered for reimbursement, up to the benet

maximum. Any expenses incurred using other payment

sources will not be considered. For trip interruption/trip

delay coverage, benets are payable to you as long as any

portion of the prepaid travel arrangements are charged to

the Cardmember’s Card, up to the benet maximum. This

denition is extended to include a common carrier ticket or

accommodations obtained through the redemption of points

earned under the Card reward program.

We, us and our refer to Royal & Sun Alliance Insurance

Company of Canada (the Insurer) or Global Excel, as

applicable.

You, yourself and your refer to the insured person.

WHO IS ELIGIBLE FOR THIS INSURANCE?

1. This insurance must be:

a) Purchased the same day you book your trip or prior

to any cancellation penalties being in effect;

b) Purchased prior to the date of departure from your

province or territory of residence;

c) Purchased by a Cardmember with a Card account

for a trip where any portion of the trip costs was paid

with the Card, or by redeeming points earned under

the Card reward program provided any applicable

taxes are charged to the Card.

2. You must meet the following conditions to be eligible for

this insurance:

a) You must be a Cardmember, a Cardmember’s

spouse, or a Cardmember’s dependent child;

b) You must be a Canadian resident and be covered

by the government health insurance plan of your

Canadian province or territory of residence for the

entire duration of your trip.

HOW DO YOU ENROLL AND BECOME INSURED?

The Cardmember may apply for coverage through the

Enrollment Centre by calling 1-866-587-1029 or by

applying online and charging the required premium to the

Cardmember’s Card.

If you have paid insufcient premium, the duration of coverage

will be decreased to the period that would have been provided

for the premium paid, starting on your effective date.

HOW DO YOU PAY FOR COVERAGE

OR GET A REFUND?

Premium

Coverage is valid upon payment of premium and subject to

the eligibility requirements. The required premium must be

paid before your effective date by charging your Card account.

Coverage will be null and void if your Card charges are invalid.

Refunds

Cancellation requests must be made in writing to us,

including your certicate number, found on your Conrmation

of Insurance, to 650-2665 King Ouest, Sherbrooke, QC

J1L 2G5.

The premium you paid can be refunded only if your trip is

cancelled before you depart on your trip and:

• the travel supplier cancels your trip and all penalties are

waived; or

4

• the travel supplier changes the travel dates and you are

unable to travel on these dates and all penalties are

waived; or

• you cancel your trip before any cancellation penalties

are in effect.

WHAT COVERAGE IS AVAILABLE?

This insurance provides coverage in addition to the Trip

Cancellation & Trip Interruption insurance provided on your

Card, whenever any portion of the trip costs (before any

cancellation penalties have been incurred) is paid with your

Card or paid using points earned under the Card reward

program provided any applicable taxes are charged to the

Card. Note: Trips will not be covered for Trip Cancellation

or Trip Interruption, if purchased with points from a reward

program other than the Card reward program.

Coverage under this plan may be purchased for Sum Insured

Amounts which are in excess of the sum insured amount

provided under the Trip Cancellation & Trip Interruption

Insurance provided on your Card.

All Sum Insured Amounts under this coverage are applicable

for the period of insurance for all insured persons combined.

Sum Insured Amount Options from $1,000 up to a maximum

of $15,000 per period of insurance are available. The

Sum Insured Amount you select will be indicated on your

Conrmation of Insurance.

WHEN DOES COVERAGE BEGIN AND END?

Coverage begins on the effective date shown on your

Conrmation of Insurance and ends on the earliest of:

a) the return date shown on your Conrmation of Insurance,

or

b) the date you actually return to your Canadian province

or territory of residence, or,

c) the date on which the maximum sum payable by the

Insurer hereunder is reached.

CAN COVERAGE BE EXTENDED?

Coverage automatically extends as follows:

1. When you or your travelling companion are hospitalized

due to a medical emergency on your scheduled return

date, your coverage will remain in force during the period

of hospitalization and up to 5 days following discharge

from hospital.

2. Coverage is automatically extended for up to 5 days

when you must delay your scheduled return date due to

your or your travelling companion’s medical emergency.

3. Coverage is automatically extended for up to 72 hours

when the delay of a common carrier in which you are

a passenger causes your trip to extend beyond your

scheduled return date.

4. Regardless of the automatic extensions above, coverage

will not continue beyond 365 days from your latest date

of departure from your departure point.

TERRORISM COVERAGE

Where an act of terrorism directly or indirectly causes a loss

that would otherwise be payable under one of the covered

risks in accordance with the terms and conditions of the

insurance, this Certicate of Insurance will provide coverage

as follows:

a) We will, for Cancellation & Interruption claims, except

in the case of catastrophic event, reimburse you up to a

maximum of 100% of your eligible loss.

b) We will, for Cancellation & Interruption claims resulting in

a catastrophic event, and subject to the limits described

in paragraph d), reimburse you up to a maximum of 50%

of your eligible loss.

c) The benets payable in accordance with paragraphs

a) and b) are in excess to all other potential sources

of recovery, including but not limited to, alternative or

replacement travel options offered by airlines, tour

operators, cruiselines and other travel suppliers and

other insurance coverage (even where such other

coverage is described as excess) and will only respond

after you have exhausted all such other sources.

d) The benets payable in accordance with paragraph

b) shall be paid out of a fund and, where total claims

exceed fund limits, eligible claims shall be reduced on

a pro rata basis so that the maximum payment out of

the fund under all insurance plans underwritten by us

shall be $5,000,000 per act of terrorism or series of acts

of terrorism occurring within a 72-hour period. The total

maximum payment out of the fund under all insurance

plans underwritten by us shall be $10,000,000 per

calendar year regardless of the number of acts of

terrorism. If, in our judgment, the total of all payable

claims under one or more acts of terrorism may exceed

the applicable fund maximum limits, your prorated claim

will be paid after the end of the calendar year.

TRIP CANCELLATION &

TRIP INTERRUPTION INSURANCE

This coverage provides benets for:

• cancelling your trip before leaving your departure point,

• transportation to your next destination,

• an early return to your departure point, or

• the delay of your trip beyond the scheduled return date.

When does the risk occur?

• Trip Cancellation – the risk occurs before your trip.

• Trip Interruption – the risk occurs during your trip.

• Trip Delay – the risk occurs during your trip and results

in your being delayed, beyond your scheduled return

date, from returning to your departure point.

5

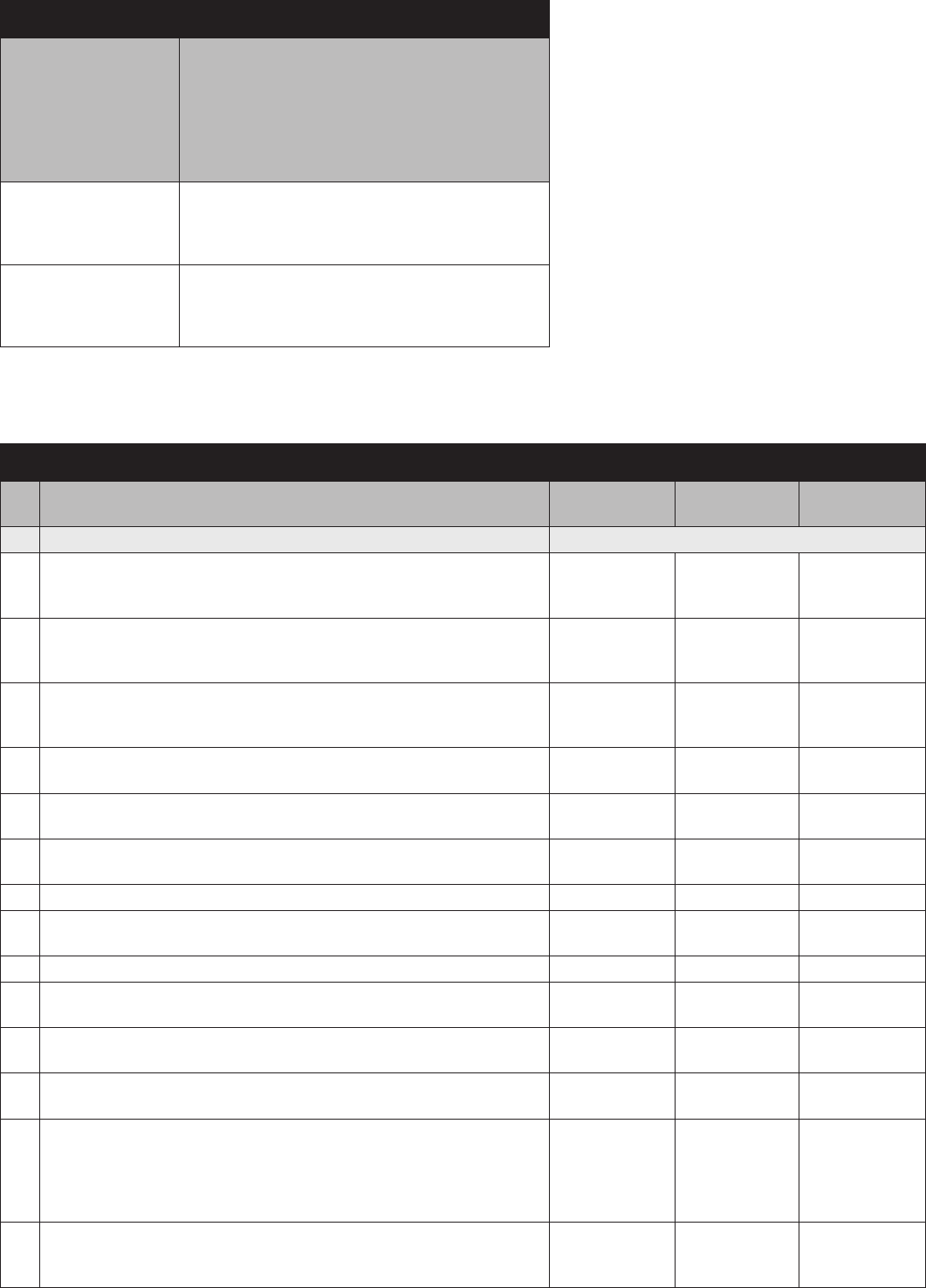

Trip Cancellation & Trip Interruption Insurance

Risk

The Sum Insured Amount purchased is

in excess of the sum insured amount

provided under the Trip Cancellation &

Trip Interruption Insurance provided on

your Card and is for all insured persons

combined

Trip Cancellation/

Prior to Departure

Up to the Sum Insured Amount per period of

insurance as shown on your Conrmation of

Insurance

Trip Interruption/

After Departure

Up to the Sum Insured Amount per period of

insurance as shown on your Conrmation of

Insurance

WHAT ARE THE RISKS INSURED?

What are you covered for? What are you eligible for?

Trip

Cancellation

Trip

Interruption

Trip

Delay

BENEFIT(S)

1. Your emergency medical condition. A

B & D, or

B & E, or

B & F

E

2.

The admission to a hospital following an emergency of a member

of your immediate family (who is not at your destination), your

business partner, key employee or caregiver.

A B & E not applicable

3.

The emergency medical condition of a member of your immediate

family (who is not at your destination), your business partner, key

employee or caregiver.

A B & E not applicable

4.

The admission to a hospital of your host at destination, following

an emergency medical condition.

A B & E not applicable

5. The emergency medical condition of your travelling companion. A

B & D, or

B & E, or B & F

E

6.

The emergency medical condition of your immediate family

member who is at your destination.

A B & E E

7. Your death. A B not applicable

8.

The death of your immediate family member or friend (who is not at

your destination), your business partner, key employee or caregiver.

A B & E not applicable

9. The death of your travelling companion. A B & E E

10.

The death of your travelling companion’s immediate family

member, business partner, key employee or caregiver.

A B & E not applicable

11.

The death of your host at destination, following an emergency

medical condition.

A B & E not applicable

12.

The death of your immediate family member or friend, who is at

your destination.

A B & E E

13.

A travel advisory issued by the Government of Canada of “Avoid

non-essential travel” or “Avoid all travel” to a specic country,

region or area originally ticketed for a period that includes your

trip, provided the advisory is issued after the later of the day you

booked your trip or the date you purchased this insurance.

A

B & E, or

B & F

not applicable

14.

A transfer by the employer with whom you or your spouse is

employed on your effective date, which requires the relocation of

your principal residence.

A B & E not applicable

6

WHAT ARE THE BENEFITS?

Prepaid Travel Arrangements – Reimbursement to you of

the expenses you actually incur as a result of one of the

insured risks up to the sum insured for:

A. The portion of your travel arrangements purchased

before your departure date that are non-refundable and

non-transferable to another date (not applicable if trip

purchased with points from a reward program other than

the Card reward program).

B. The unused portion of your travel arrangements

purchased before your departure date that are non-

refundable and non-transferable to another travel date

(not applicable if trip purchased with points from a

reward program other than the Card reward program).

This does not include reimbursement for prepaid unused

transportation back to your departure point.

C. The unused portion of your travel arrangements

purchased before your departure date that are non-

refundable and non-transferable to another travel date

(not applicable if trip purchased with points from a reward

program other than your Card’s reward program).

Any credits provided by the airline or travel supplier for travel

on another date, are considered transferable amounts and

shall not be payable under this insurance.

Transportation – Reimbursement to you of the expenses

you actually incur as a result of one of the insured risks up to

the sum insured for the extra cost of:

D. Your economy class transportation via the most cost-

effective route to rejoin a tour or group.

E. Your economy class transportation via the most cost-

effective route to your departure point.

F. Your economy class one-way air fare via the most cost-

effective route to your next destination (inbound and

outbound).

LIMITATIONS OF COVERAGE

Any transportation benets under this insurance must be

undertaken on the earliest of:

• the date when your travel is medically possible; and

• within 10 days following your originally scheduled return

date if your delay is not the result of hospitalization; or

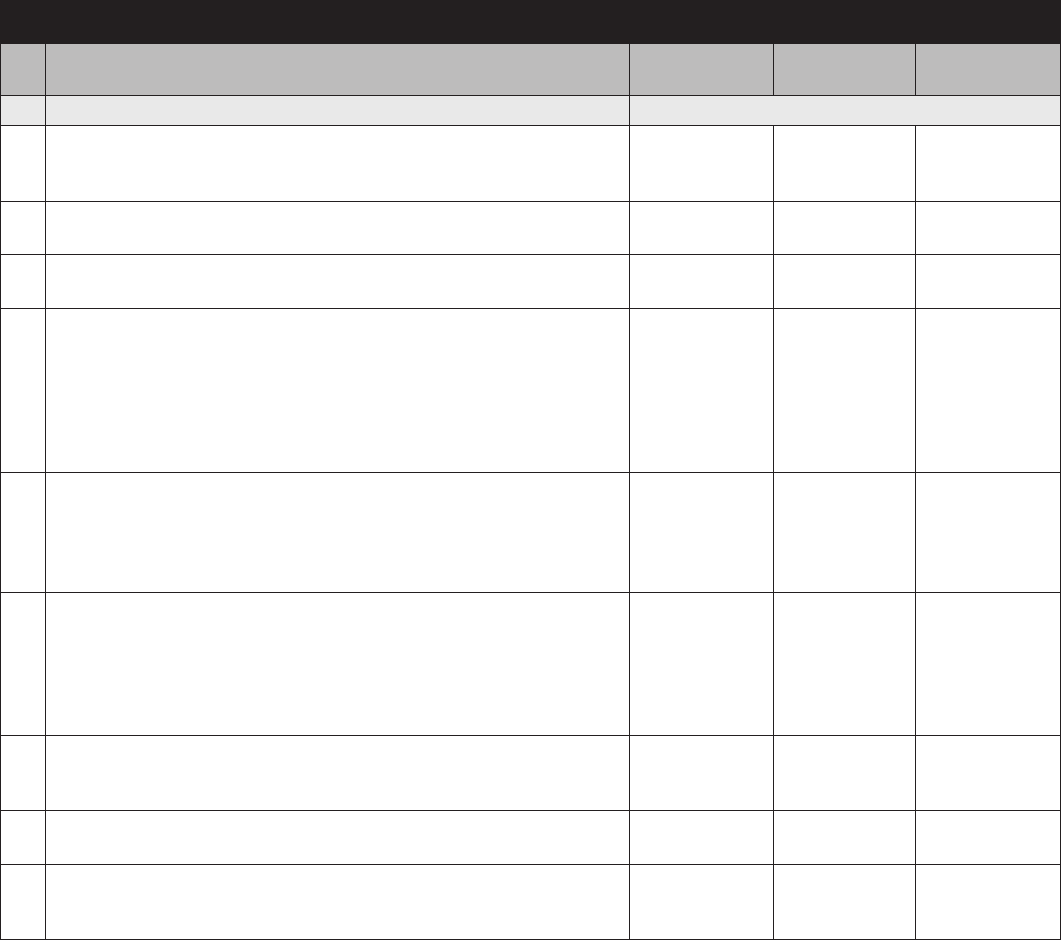

What are you covered for? What are you eligible for?

Trip

Cancellation

Trip

Interruption

Trip

Delay

BENEFIT(S)

15.

The involuntary loss of your or your spouse’s permanent

employment (not contract employment) due to lay-off or dismissal

without just cause.

A B & E not applicable

16.

Cancellation of your business meeting beyond your or your

employer’s control.

A B & E not applicable

17.

Your being summoned to service in the case of reservists, active

military, police, essential medical personnel and re personnel.

A B & E not applicable

18.

Delay of a private automobile resulting from the mechanical failure

of that automobile, weather conditions, earthquakes, volcanic

eruptions, a trafc accident, or an emergency police-directed

road closure, causing you to miss a connection or resulting in the

interruption of your travel arrangements, provided the automobile

was scheduled to arrive at the point of departure at least 2 hours

before the scheduled time of departure.

not applicable B & F E

19.

Delay of your common carrier, resulting from the mechanical failure

of that carrier, a trafc accident, an emergency police-directed

road closure, weather conditions, earthquakes or volcanic

eruptions, causing you to miss a connection or resulting in the

interruption of your travel arrangements.

not applicable B & F E

20.

Delay of your departure, resulting from the mechanical failure

of your common carrier, a trafc accident, an emergency

police-directed road closure, weather conditions, or grounding

of your air transportation, causing you to miss your scheduled

cruise or tour, and no alternative travel arrangements can be

made for you to join the cruise or tour.

N/A C N/A

21.

An event completely independent of any intentional or negligent

act that renders your principal residence uninhabitable or place of

business inoperative.

A B & E not applicable

22.

The quarantine or hijacking of you, your spouse or your dependent

child.

A B & E D

23.

You, your spouse or your dependent child being a) called for jury

duty; b) subpoenaed as a witness; or c) required to appear as a

party in a judicial proceeding, during your trip.

A B & E not applicable

7

• within 30 days following your originally scheduled return

date if your delay is the result of hospitalization, when

the benet is payable because of a medical condition

covered under one of the insured risks.

• when a cause of cancellation occurs (the event or series

of events that triggers one of the insured risks listed

above) before your departure date, you must:

a) cancel your trip with the travel agent, airline, tour

company, carrier or travel authority etc. immediately,

but no later than the business day following the

cause of cancellation, and

b) advise the Insurer at the same time.

The Insurer’s maximum liability is the amounts or portions

indicated in your trip contract that are non-refundable at the

time of the cause of cancellation or on the next business day.

WHAT ASSISTANCE SERVICES ARE

AVAILABLE?

Under this Certicate of Insurance, the following assistance

services are available to you:

Emergency Message Centre

In case of a medical emergency, Global Excel will help

exchange important messages with your immediate family,

business or physician.

PRE-EXISTING CONDITION EXCLUSION

In addition to the exclusions outlined below under “General

Exclusions,” the following exclusion applies to you.

This insurance does not cover any losses or expenses

caused directly or indirectly as a result of:

a) Your or your spouse’s medical condition or related

condition (whether or not the diagnosis has been

determined), if at any time in the 90 days before your

effective date, your or your spouse’s medical condition

or related condition has not been stable.

b) Your or your spouse’s heart condition (whether or not

the diagnosis has been determined), if at any time in the

90 days before your effective date:

• any heart condition has not been stable; or

• you or your spouse have taken nitroglycerin more

than once per week specically for the relief of angina

pain.

c) Your or your spouse’s lung condition (whether or not the

diagnosis has been determined), if at any time in the 90

days before your effective date:

• any lung condition has not been stable; or

• you or your spouse have been treated with home

oxygen or taken oral steroids (prednisone or

prednisolone) for any lung condition.

GENERAL EXCLUSIONS

This insurance will not pay any expenses relating to or in any

way associated with:

1. Cancellation or interruption when you are aware, on

the effective date, of any reason that might reasonably

prevent you from travelling as booked.

2. Any trip purchased with points from a reward program

other than the Card reward program.

3. A trip undertaken to visit or attend an ailing person,

when the medical condition or death of that person is

the cause of the claim.

4. The schedule change of a medical test or surgery that

was originally scheduled before your period of insurance.

5. Routine pre-natal care.

6. If you are pregnant, your pregnancy or the birth and

delivery of your child, or any complications of either,

occurring in the nine weeks before or after your expected

delivery date as determined by your primary care

physician in your province. Note that a child born during

a trip, even if born outside of the nine weeks before or

after the expected delivery date, shall not be regarded

as an insured person and shall not have coverage under

this certicate for the entire duration of the trip in which

the child is born.

7. Participation:

a) as a professional athlete in a sporting event including

training or practice;

b) in any motorized race or motorized speed contest;

c) in scuba diving (unless you hold a basic SCUBA

designation from a certied school or other licensing

body), hang-gliding, rock climbing, paragliding,

skydiving, parachuting, bungee jumping, mountain

climbing, rodeo, heli-skiing, any downhill skiing or

snowboarding outside marked trails or any cycling

racing event or ski racing event.

8. Your commission of a criminal act or your direct or

indirect attempt to commit a criminal act.

9. Your intentional self-inicted injury, suicide or attempt to

commit suicide.

10. Any medical condition arising from, or in any way related

to, your chronic use of alcohol or drugs whether prior to

or during your trip.

11. Your abuse of medication, drug or alcohol or deliberate

non-compliance with prescribed medical therapy or

treatment whether prior to or during your trip.

12. Your anxiety or panic attack or a state of mental or

emotional stress unless such state was sufciently

severe as to require a medical consultation.

13. Any medical condition if you undertake your trip with the

prior knowledge that you will require or seek treatment,

surgery, investigations, palliative care or alternative

therapy of any kind, regardless of whether the treatment,

surgery, investigations, palliative care or alternative

therapy is related in any way to the medical condition.

14. War (declared or not), act of foreign enemies or rebellion.

15. Any medical condition you suffer or contract, or any

loss you incur in a specic country, region or area

while a travel advisory of “Avoid non-essential travel”

or “Avoid all travel” is in effect for that specic country,

region or area and the travel advisory was issued by

the Government of Canada before your departure date,

even if the trip is undertaken for essential reasons. This

exclusion only applies to medical conditions or losses

which are related, directly or indirectly, to the reason for

which the travel advisory was issued.

If the travel advisory is issued after your departure date,

your coverage under this insurance in that specic

country, region or area will be restricted to a period of

8

10 days from the date the travel advisory was issued, or

to a period that is necessary for you to safely evacuate

the country, region or area, after which coverage will

be limited to medical conditions or losses which are

unrelated to the reason for which the travel advisory was

issued, while the travel advisory remains in effect.

16. Ionizing radiation or radioactive contamination from any

nuclear fuel or waste which results from the burning

of nuclear fuels; or, the radioactive, toxic, explosive or

other dangerous properties of nuclear machinery or any

part of it.

17. A trip cancellation, trip interruption or trip delay which

is related, directly or indirectly, to Coronavirus disease

2019 (COVID-19).

HOW DO YOU SUBMIT A CLAIM?

1. When you call Global Excel at the time of an emergency,

you are given all the information required to le a claim.

Otherwise, please refer to the instructions below.

2. This insurance does not cover fees charged for

completing a medical certicate.

3. You must le your claim with us within 90 days of your

return to your departure point.

4. If you need a Claim & Authorization form, please contact

our Claims Department at:

73 Queen Street, Sherbrooke, Quebec J1M 0C9

1-844-780-0501 or +819-780-0501

We require the fully completed Claim & Authorization form,

and where applicable:

• A medical document, fully completed by the legally

qualied physician in active personal attendance and in

the locality where the medical condition occurred stating

the reason why travel was impossible, the diagnosis and

all dates of treatment.

• Written evidence of the risk insured which was the cause

of cancellation, interruption or delay.

• Tour operator terms and conditions.

• Copy of AMEX statement or invoice showing payment of

your trip.

• Complete original unused transportation tickets and

vouchers.

• All receipts for the prepaid land arrangements.

• Original passenger receipts for new tickets.

• Reports from the police or local authorities documenting

the cause of the missed connection.

• Detailed invoices and/or receipts from the service

provider(s).

FAILURE TO COMPLETE THE REQUIRED CLAIM &

AUTHORIZATION FORM IN FULL WILL DELAY THE

ASSESSMENT OF YOUR CLAIM.

OTHER CLAIM INFORMATION

During the processing of a claim, the Insurer may require you

to undergo a medical examination by one or more physicians

selected by the Insurer and at the Insurer’s expense.

You agree that the Insurer and its agents have:

a) your consent to verify your health card number and

other information required to process your claim, with

the relevant government and other authorities;

b) your authorization to physicians, hospitals and other

medical providers to provide to us, and Global Excel,

any and all information they have regarding you, while

under observation or treatment, including your medical

history, diagnoses and test results; and

c) your agreement to disclose any of the information

available under a) and b) above to other sources, as

may be required for the processing of your claim for

benets obtainable from other sources.

You may not claim or receive in total more than 100% of

your total covered expenses or the actual expenses which

you incurred, and you must repay to us any amount paid or

authorized by us on your behalf if and when we determine

that the amount was not payable under the terms of your

insurance.

Limitation Periods

Every action or proceeding against an insurer for the

recovery of insurance money payable under the contract is

absolutely barred unless commenced within the time set out

in the Insurance Act (for actions or proceedings governed

by the laws of British Columbia, Alberta and Manitoba), the

Limitations Act 2002 (for actions or proceedings governed

by the laws of Ontario), Article 2925 of the Civil Code of

Quebec (for actions or proceedings governed by the laws of

Quebec), or other applicable legislation.

GENERAL CONDITIONS

1. Any of our policies are excess insurance and are the

last payors. All other sources of recovery, indemnity

payments or insurance coverage must be exhausted

before any payments will be made under any of our

policies.

2. If you are eligible, from any other insurer, for benets

similar to the benets provided under this insurance,

the total benets paid to you by all insurers cannot

exceed the actual expense that you have incurred. We

will coordinate the payment of benets with all insurers

from whom you are eligible for benets similar to those

provided under this insurance, to a maximum of the

largest amount specied by each insurer.

3. If you incur expenses covered under this insurance due

to the fault of a third party, we may take action against

the party at fault. You agree to cooperate fully with us

and to allow us, at our own expense, to bring a law suit in

your name against the third party. If you recover against

a third party, you agree to hold in trust sufcient funds to

reimburse us for the amounts paid under the insurance.

4. The statements you furnish as evidence of insurability

at the time of application are material to the decision to

approve your application for insurance. Accordingly, any

information that has been misrepresented, mis-stated or

is incomplete may result in this Certicate of Insurance

and your coverage being null and void, in which case no

benets will be paid. You must submit any subsequent

changes to the information in writing before you depart

on your trip.

9

5. Payment, reimbursement and amounts shown

throughout this contract are in Canadian dollars, unless

otherwise stated. If currency conversion is necessary,

we will use the exchange rate on the date the claim is

paid. This insurance will not pay for any interest.

6. This contract is void in the case of fraud or attempted

fraud by you, or if you conceal or misrepresent any

material fact or circumstance concerning this insurance.

7. Throughout this document, any reference to age refers

to your age on your effective date.

8. When making a claim under this insurance, you must

provide the applicable documents we require. Failure

to provide the applicable documentation will invalidate

your claim.

9. The Insurer, Global Excel, Amex Bank of Canada and

their agents are not responsible for the availability,

quality or results of medical treatment or transportation,

or your failure to obtain medical treatment.

10. This document, including the Application for Insurance,

and the Conrmation of Insurance is the entire contract

between you and the Insurer. Despite any other provision

of this contract, this contract is subject to any applicable

federal and provincial statutes concerning contracts

of insurance.

11. On request, you or a claimant under the contract will

be provided with a copy of your application and any

evidence of your insurability provided to the Insurer. On

reasonable notice you or a claimant under the contract

will be provided with a copy of the group contract

(applicable only in those provinces where mandated

by legislation and subject to certain access limitations

permitted by applicable legislation).

12. The Insurer is required to comply with economic, nancial

and trade sanctions (“Sanctions”) imposed by Canada

and may be required to comply with Sanctions imposed

by the United States in certain circumstances. The

Insurer is a member of the RSA Group whose principal

insurance company in the United Kingdom is required to

comply with Sanctions imposed by the European Union

and the United Kingdom and the parties acknowledge

that the Insurer intends to adhere to the same standard.

Accordingly, the Insurer shall not provide any coverage

or be liable to provide any indemnity or payment or

other benet under this certicate which would breach

applicable Sanctions imposed under the laws of

Canada, the European Union, the United Kingdom, or

the United States.

IMPORTANT NOTICE ABOUT

YOUR PERSONAL INFORMATION

Royal & Sun Alliance Insurance Company of Canada

(“we”, “us”) collect, use and disclose, personal information

(including to and from your agent or broker, our afliates

and/or subsidiaries, referring organizations and/or third

party providers/suppliers) for insurance purposes, such

as administering insurance, investigating and processing

claims and providing assistance services.

Typically, we collect personal information from individuals

who apply for insurance, and from policyholders, insureds

and claimants. In some cases we also collect personal

information from and exchange personal information with

family, friends or travelling companions when a policyholder,

insured or claimant is unable, for medical or other reasons,

to communicate directly with us. We also collect and disclose

information for the insurance purposes from, to and with,

third parties such as, but not necessarily limited to, health

care practitioners and facilities in Canada and abroad,

government and private health insurers and family members

and friends of policyholders, insureds or claimants. In some

instances we may additionally maintain or communicate

or transfer information to health care and other service

providers located outside of Canada, particularly in those

jurisdictions to which an insured may travel. As a result,

personal information may be accessible to authorities in

accordance with the law of these other jurisdictions. For

more information about our privacy practices or for a copy of

our privacy policy, visit www.rsatravelinsurance.com.

AMEX

®

Travel Insurance is underwritten by Royal & Sun Alliance Insurance Company of Canada.

©2021 Royal & Sun Alliance Insurance company of Canada. All rights reserved.

®

RSA, RSA &

Design and related words and logos are trademarks and the property of RSA Insurance Group

plc, licensed for use by Royal & Sun Alliance Insurance Company of Canada.

®

Used by Amex Bank of Canada under license from American Express.

®

“Global Excel” and the Global Excel logo are registered trademarks of Global Excel

Management Inc.