IN THE UNITED STATES DISTRICT COURT

FOR THE DISTRICT OF COLUMBIA

UNITED STATES OF AMERICA,

Department of Justice, Antitrust Division

450 5th Street, N.W., Suite 7000

Washington, D.C. 20530

STATE OF NEW YORK,

Office of the Attorney General

120 Broadway, 26

th

Floor

New York, NY 10271-0332

STATE OF WASHINGTON,

Office of the Attorney General

800 Fifth Avenue, S. 2000

Seattle, WA 98104

STATE OF CALIFORNIA,

Office of the Attorney General

455 Golden Gate Avenue, Suite 11000

San Francisco, CA 94102

STATE OF ILLINOIS,

Office of the Attorney General

100 W. Randolph Street

Chicago, IL 60601

COMMONWEALTH OF MASSACHUSETTS

Office of the Attorney General

th

One Ashburton Place, 18

Floor

Boston, MA 02108

STATE OF OHIO,

Office of the Attorney Genera]

150 E. Gay Street, 23

rd

Floor

Columbus, OH 43215

and

COMMONWEALTH OF PENNSYLVANIA,

Office of the Attorney General

14

th

Floor, Strawberry Square

Harrisburg, PA 17120

,

Plaintiffs,

Civil Action No. 11-01560 (ESH)

2

v.

AT&T INC.,

One AT&T Plaza

208 South Akard Street

Dallas, Texas 75202

T-MOBILE USA, INC.,

12920 SE 38

th

Street

Bellevue, Washington 98006

and

DEUTSCHE TELEKOM AG,

Friedrich-Ebert-Allee

Bonn, Germany D-53113

Defendants.

AMENDED COMPLAINT

The United States of America, acting under the direction of the Attorney General of the

United States, and the States of New York, Washington, California, Illinois, and Ohio and the

Commonwealths of Massachusetts and Pennsylvania, acting under the direction of their

respective Attorneys General and other authorized officials ("Plaintiff States") (collectively,

"Plaintiffs"), bring this civil action to enjoin the merger of two of the nation's four largest mobile

wireless telecommunications services providers, AT&T Inc. ("AT&T") and T-Mobile USA, Inc.

("T-Mobile"), and to obtain equitable and other relief as appropriate. Plaintiffs allege as follows:

I. NATURE OF THE ACTION

1. Mobile wireless telecommunications services are vital to the everyday lives of

hundreds of millions of Americans. From their modest beginnings in the 1980s, when handsets

were the size of a brick and coverage areas were limited, mobile wireless telecommunications

devices have evolved into a profusion of smartphones, feature phones, tablets, data cards,

e-readers, and other devices that use the nationwide mobile wireless telecommunications

networks. Mobile wireless telecommunications services have become indispensable both to the

way we live and to the way companies do business throughout the United States. Innovation in

wireless technology drives innovation throughout our 21

st

-century information economy, helping

to increase productivity, create jobs, and improve our daily lives. Vigorous competition is

essential to ensuring continued innovation and maintaining low prices.

2. On March 20, 2011, AT&T entered into a stock purchase agreement to acquire

T-Mobile from its parent, Deutsche Telekom AG ("DT"), and to combine the two companies'

mobile wireless telecommunications services businesses ("Transaction Agreement"). AT&T,

with approximately 98.6 million connections to mobile wireless devices, and T-Mobile, with

approximately 33.6 million connections, serve customers throughout the United States, with

networks that each reach the homes of at least 90 percent of the U.S. population. AT&T and

T-Mobile are two of only four mobile wireless providers with nationwide networks and a variety

of competitive attributes associated with that national scale and presence. The other two

nationwide networks are operated by Verizon Wireless ("Verizon") and Sprint Nextel Corp.

("Sprint"). Although smaller providers exist, they are significantly different from these four.

For instance, none of the smaller carriers' voice networks cover even one-third of the U.S.

population, and the largest of these smaller carriers has less than one-third the number of

wireless connections as T-Mobile. Similarly, regional competitors often lack a nationwide data

network, nationally recognized brands, significant nationwide spectrum holdings, and timely

access to the most popular handsets. Collectively, the "Big Four" - AT&T, T-Mobile, Verizon,

3

and Sprint - provide more than 90 percent of service connections to U.S. mobile wireless

devices.

3. Due to the advantages arising from their scale and scope of coverage, each of the

Big Four nationwide carriers is especially well-positioned to drive competition, at both a national

and local level, in this industry. T-Mobile in particular - a company with a self-described

"challenger brand," that historically has been a value provider, and that even within the past few

months had been developing and deploying "disruptive pricing" plans - places important

competitive pressure on its three larger rivals, particularly in terms of pricing, a critically

important aspect of competition. AT&T's elimination of T-Mobile as an independent, low-

priced rival would remove a significant competitive force from the market. Additionally,

T-Mobile's investment in an advanced high-speed network and its innovations in technology and

mobile wireless telecommunications services have provided, and continue to provide, consumers

with significant value. Thus, unless this acquisition is enjoined, customers of mobile wireless

telecommunications services likely will face higher prices, less product variety and innovation,

and poorer quality services due to reduced incentives to invest than would exist absent the

merger. Because AT&T's acquisition of T-Mobile likely would substantially lessen competition

in violation of Section 7 of the Clayton Act, 15 U.S.C. § 18, the Court should permanently enjoin

this acquisition.

II. JURISDICTION AND VENUE

4. The United States files this Complaint under Section 15 of the Clayton Act,

15 U.S.C. § 25, to prevent and restrain Defendants from violating Section 7 of the Clayton Act,

as amended, 15 U.S.C. § 18. The Plaintiff States, by and through their respective Attorneys

4

General and other authorized officials, bring this action under Section 16 of the Clayton Act,

15 U.S.C. § 26, to prevent and restrain Defendants from violating Section 7 of the Clayton Act,

15 U.S.C. § 18. The Plaintiff States bring this action in their sovereign capacities and as parens

patriae on behalf of the citizens, general welfare, and economy of each of their states.

5. AT&T, DT, and T-Mobile are engaged in interstate commerce and in activities

substantially affecting interstate commerce and commerce in each of the Plaintiff States. The

Court has subject-matter jurisdiction over this action pursuant to Sections 15 and 16 of the

Clayton Act, 15 U.S.C. §§ 25 and 26, and 28 U.S.C. §§ 1331, 1337, 1345.

6. Venue is proper in this District under Section 12 of the Clayton Act, 15 U.S.C.

§ 22 and 28 U.S.C. § 1391(b)(1), (c). Defendants AT&T, DT, and T-Mobile transact business

and are found within the District of Columbia. The Defendants have consented to personal

jurisdiction in this judicial district.

III. THE DEFENDANTS AND THE TRANSACTION

7. AT&T, with headquarters in Dallas, Texas, is a corporation organized and

existing under the laws of the State of Delaware. AT&T is one of the world's largest providers

of communications services, and the second-largest mobile wireless telecommunications services

provider in the United States, as measured by subscribers. AT&T provides mobile wireless

telecommunications services in 50 states, the District of Columbia, and Puerto Rico, providing

approximately 98.6 million connections to mobile wireless devices. In 2010, AT&T's revenues

from mobile wireless telecommunications services were $53.5 billion, and its total revenues were

more than $124 billion.

5

8. T-Mobile, with headquarters in Bellevue, Washington, is a corporation organized

and existing under the laws of the State of Delaware. T-Mobile is the fourth-largest mobile

wireless telecommunications services provider in the United States as measured by subscribers.

T-Mobile provides mobile wireless telecommunications services in 48 states, the District of

Columbia, and Puerto Rico, providing approximately 33.6 million connections to mobile

wireless devices. In 2010, T-Mobile's revenues from mobile wireless telecommunications

services were approximately $18.7 billion. T-Mobile is a wholly owned subsidiary of Deutsche

Telekom AG.

9. Deutsche Telekom AG is a German corporation headquartered in Bonn, Germany.

It is the largest telecommunications operator in Europe with wireline and wireless interests in

numerous countries and total annual revenues in 2010 of €62.4 billion.

10. Pursuant to the Transaction Agreement, AT&T will acquire T-Mobile for cash

and stock worth approximately $39 billion. If this transaction is consummated, AT&T and

T-Mobile would become the nation's largest wireless carrier. The merged firm would have

approximately 132 million connections to mobile wireless devices in the United States, with

more than $72 billion in mobile wireless telecommunications services revenues.

IV. TRADE AND COMMERCE

A. Relevant Product Markets

11. Mobile wireless telecommunications services allow customers to engage in

telephone conversations and obtain data services using radio transmissions without being

confined to a small area during a call or data session, and without requiring an unobstructed line

of sight to a radio tower. Mobility is highly valued by customers, as demonstrated by the more

6

than 300 million connections to mobile wireless devices in the United States. In 2010, revenues

from the sale of mobile wireless telecommunications services in the United States were

approximately $160 billion. To provide service, mobile wireless telecommunications carriers

typically must acquire FCC licenses to utilize electromagnetic spectrum to transmit signals;

deploy extensive networks of radio transmitters and receivers at numerous telecommunications

towers and other sites; and obtain "backhaul" - copper, microwave, or fiber connections from

those sites to the rest of the network. They must also deploy switches as part of their networks,

and interconnect their networks with the networks of wireline carriers and other mobile wireless

telecommunications services providers. To be successful, providers also typically must engage

in extensive marketing and develop a comprehensive network for retail distribution.

12. Mobile wireless telecommunications services include both voice and data services

(e.g., texting and Internet access) provided over a radio network and allow customers to maintain

their telephone calls or data sessions wirelessly when traveling. Mobile wireless

telecommunications providers offer their services on a variety of devices including mobile

phones, smartphones, data cards, tablet computers, and netbooks. In addition, an increasingly

important group of customers are building mobile wireless capability into new devices, such as

e-readers and vehicle tracking equipment, and contracting for mobile wireless

telecommunications services on behalf of their own customers. There are no cost-effective

alternatives to mobile wireless telecommunications services. Because neither fixed wireless

services nor wireline services are mobile, they are not regarded by consumers of mobile wireless

telecommunications services as reasonable substitutes. In the face of a small but significant

price increase imposed by a hypothetical monopolist it is unlikely that a sufficient number of

customers would switch some or all of their usage from mobile wireless telecommunications

7

services to fixed wireless or wireline services such that the price increase or reduction in

innovation would be unprofitable. Mobile wireless telecommunications services accordingly is a

relevant product market under Section 7 of the Clayton Act, 15 U.S.C. § 18.

13. Business customers, sometimes known as enterprises, and government customers

often select and contract for mobile wireless telecommunications services for use by their

employees in their professional and/or personal capacities. These customers constitute a distinct

set of customers for mobile wireless telecommunications services, and sales of mobile wireless

telecommunications services covered by enterprise or government contracts amounted to more

than $40 billion last year. The selection and service requirements for enterprise and government

customers are materially different than those of individual consumers. Enterprise and

government customers typically are served by dedicated groups of employees who work for the

mobile wireless carriers, and such customers generally select their providers by soliciting bids,

sometimes through an "RFP" (request for proposal) process. Enterprise and government

customers typically seek a carrier that can provide services to employees, facilities, and devices

that are geographically dispersed. Therefore, enterprise and government customers require

services that are national in scope. In addition, prices and terms tend to be more attractive for

enterprise and government customers than for individuals, and include features such as pooled

minutes as well as favorable device upgrade and replacement policies. Enterprise and

government service contracts often are individually negotiated, with carriers frequently

providing discounts on particular RFPs in response to their competitors' offers. There are no

good substitutes for mobile wireless telecommunications services provided to enterprise and

government customers, nor would a significant number of such customers switch to purchasing

such services through ordinary retail channels in the event of a small but significant price

8

increase in services offered through the enterprise and government sales channels. Accordingly,

mobile wireless telecommunications services provided to enterprise and government customers

is a relevant product market under Section 7 of the Clayton Act, 15 U.S.C. § 18.

B. Relevant Geographic Markets

14. Mobile wireless telecommunications services are sold to consumers in local

markets that are affected by nationwide competition among the dominant service providers. It is

therefore appropriate both to identify local markets in which consumers purchase mobile

wireless telecommunications services and to identify the nature of the nationwide competition

affecting those markets. AT&T's acquisition of T-Mobile will have nationwide competitive

effects across local markets.

15. Because most customers use mobile wireless telecommunications services at and

near their workplaces and homes, they purchase services from providers that offer and market

services where they live, work, and travel on a regular basis.

16. The nation's four largest providers of mobile wireless telecommunications

services, including AT&T and T-Mobile, provide and market service on a nationwide basis.

Other providers have limited networks that cover only particular localities and regions. Those

smaller carriers typically do not market to customers outside of their respective network

coverage areas, and may not even sell to such customers; therefore, local or regional carriers are

not an attractive, or perhaps even available, option for those customers who live and work in

areas outside of these smaller providers' respective network coverage areas.

17. Accordingly, from a consumer's perspective, local areas may be considered

relevant geographic markets for mobile wireless telecommunications services. The Cellular

Market Areas ("CMAs") that the FCC has identified and used to license mobile wireless

9

telecommunications services providers for certain spectrum bands often approximate the areas

within which customers have the same competitive choices. AT&T and T-Mobile compete

against each other in local markets across the United States that collectively encompass a large

majority of U.S. mobile wireless telecommunications consumers. Indeed, AT&T and T-Mobile

compete head to head in at least 97 of the nation's top 100 CMAs as well as in many other areas.

These 97 CMAs alone include over half of the U.S. population. Each of these 97 CMAs,

identified in Appendix B, effectively represents an area in which the transaction likely would

substantially lessen competition for mobile wireless telecommunications services and each

constitutes a relevant geographic market under Section 7 of the Clayton Act, 15 U.S.C. § 18. In

addition, as described below, the nationwide effects of the transaction likely would substantially

lessen competition in local markets across the nation.

18. In competing for customers in the 97 markets identified in Appendix B and other

CMAs, AT&T and T-Mobile (as well as Verizon and Sprint) utilize networks that cover the vast

majority of the U.S. population, advertise nationally, have nationally recognized brands, and

offer pricing, plans, and devices that are available nationwide. For a variety of reasons, there is

little or no regional variation in the pricing plans offered by the Big Four nationwide carriers.

Nationwide pricing simplifies customer service and billing, reduces consumer confusion that

might otherwise result from regional pricing disparities, and allows the carriers to take advantage

of nationwide advertising in promoting their services. Similarly, when the Big Four carriers

make devices available to the public, they typically make them available nationwide. This too

minimizes customers' confusion and dissatisfaction, and allows the carriers to take advantage of

nationwide marketing. In addition, the Big Four carriers generally deploy system technology on

a nationwide basis, including critical components such as network standards, e.g., LTE or

10

HSPA+. These technological choices are an important aspect of competition in the mobile

wireless telecommunications services market.

19. The national decision-making of the Big Four carriers results in nationwide

competition across local markets. Each of the Big Four firms making a competitive choice

regarding a pricing plan, or other national competitive attribute, will consider competitive

conditions across the United States, as the decision will take effect throughout the United States.

Because competitive decisions affecting technology, plans, prices, and device offerings are

typically made at a national, rather than a local, level, the rivals that affect those decisions

generally are those with sufficient national scale and scope, i.e., the Big Four. As AT&T

acknowledged less than three years ago during a merger proceeding, it aims to "develop its rate

plans, features and prices in response to competitive conditions and offerings at the national

levels - primarily the plans offered by the other national carriers." As AT&T recognized, "the

predominant forces driving competition among wireless carriers operate at the national level."

That remains the case today.

20. Because, as AT&T admits, competition operates at a national level, it is

appropriate to consider the competitive effects of the transaction at a national level. There is no

doubt that AT&T and T-Mobile compete against each other on a nationwide basis, make many

decisions on a nationwide basis, and that this national competition is conducted in local markets

that include the vast majority of the U.S. population. Indeed, customers in local markets across

the country often face very similar choices from AT&T, T-Mobile, Verizon, and Sprint,

regardless of whether local or regional carriers also compete in any particular CMA. It is

necessary, therefore, to analyze competition at the national level in order to capture, as AT&T

has stated, "the predominant forces driving competition among wireless carriers," and the impact

11

of these forces on competitive decisions and outcomes that are fundamentally national in nature.

Thus, whereas CMAs are appropriate geographic markets from the perspective of individual

consumer choice, from a seller's perspective, the Big Four carriers compete against each other on

a nationwide basis and AT&T's acquisition of T-Mobile will have nationwide competitive

effects across local markets.

21. Enterprise and government customers often have multiple office and business

locations throughout the United States, and employees who may travel frequently. Enterprise

and government customers often contract at the same time for employees located at these

multiple locations across the country. Therefore, enterprise and government customers generally

require a mobile wireless provider with a nationwide network, and are willing to contract with a

carrier anywhere in the United States who has such a network. Accordingly, the United States is

a relevant geographic market under Section 7 of the Clayton Act, 15 U.S.C. § 18, for mobile

wireless telecommunications services offered to enterprise and government customers.

C. Concentration

22. Concentration in relevant markets is typically measured by the Herfindahl-

Hirschman Index ("HHI"), which is defined and explained in Appendix A to this Complaint.

Preliminary market share estimates demonstrate that in 96 of the nation's largest 100 CMAs - all

identified in Appendix B as representing relevant geographic markets for mobile wireless

telecommunications services - the post-merger HHI exceeds 2,500. Such markets are considered

to be highly concentrated. In one additional CMA identified in Appendix B, the post-merger

HHI falls just below 2,500 and the market would be considered moderately concentrated.

23. In 91 of the 97 CMAs identified in Appendix B as representing relevant

geographic markets for mobile wireless telecommunications services - including all of the

12

nation's 40 largest markets - preliminary market share estimates demonstrate that AT&T's

acquisition of T-Mobile would increase the HHI by more than 200 points. Such an increase is

presumed to be likely to enhance market power. In an additional 6 CMAs, the increase would be

at least 100, an increase that often raises significant competitive concerns.

24. In more than half of the CMAs identified in Appendix B as representing relevant

geographic markets for mobile wireless telecommunications services, the combined

AT&T/T-Mobile would have a greater than 40 percent share. In at least 15 of the CMAs,

including major metropolitan markets such as Dallas, Houston, Oklahoma City, Birmingham,

Honolulu, and Seattle, the combined firm would have a greater than 50 percent share - i.e., more

customers than all the other firms combined.

25. Nationally, the proposed merger would result in an HHI of more than 3,100 for

mobile wireless telecommunications services, an increase of nearly 700 points. These numbers

substantially exceed the thresholds at which mergers are presumed to be likely to enhance market

power.

26. In the national market for mobile wireless telecommunications services provided

to enterprise and government customers, the proposed merger would result in an HHI of at least

3,400, an increase of at least 300 points. These numbers exceed the thresholds above which

mergers are presumed to be likely to enhance market power.

D. Anticompetitive Effects

1. Overview of T-Mobile's Importance as an Aggressive Competitor

27. Historically and currently, T-Mobile has positioned itself as the value option for

wireless services, focusing on aggressive pricing, value leadership, and innovation. As T-Mobile

noted in a document generated in preparation for an investor's conference, the company views

13

itself as "the No. 1 value challenger of the established big guys in the market and as well

positioned in a consolidated 4-player national market." T-Mobile's Chief Marketing Officer,

Cole Brodman, a 15-year veteran of the company, described T-Mobile as having "led the

industry in terms of defining rate plan value." T-Mobile consumers benefit from the lower prices

offered by T-Mobile, while subscribers of Verizon, AT&T, and Sprint gain from more attractive

offerings that those firms are spurred to provide because of the attractive national value

proposition of T-Mobile.

28. Innovation is well known to be an important driver of economic growth.

T-Mobile has been responsible for numerous "firsts" in the U.S. mobile wireless industry, as

outlined in an internal document entitled "T-Mobile Firsts: Paving the way one first at a time."

The document lists the first Android handset, Blackberry wireless e-mail, the Sidekick (a

consumer "all-in-one" messaging device), national Wi-Fi "hotspot" access, and a variety of

unlimited service plans, among other firsts.

29. T-Mobile has also been an innovator in terms of network development and

deployment. For instance, T-Mobile was the first company to roll out and market a nationwide

network based on advanced HSPA+ technology and marketed as 4G. Such investments in new

network technologies - spurred by competition among the Big Four - are valuable to consumers

as they increase the efficiency of spectrum use and allow for more mobile wireless services

output.

30. AT&T has felt competitive pressure from T-Mobile's innovation. As a January

2010 AT&T internal document observed in analyzing the roll-out of new competitive broadband

networks by several of its competitors:

[T]he more immediate threat to AT&T is T-Mobile. . . . On January 5

th

, 2010, it

announced that it had upgraded its entire network with HSPA 7.2 covering 200M POPS.

14

It also reiterated prior statements that it would add HSPA+, capable of 3x the throughput

of HSPA 7.2, across a substantial portion of its network by 2H 2010. . . . The one-two

punch of an advanced network and the backhaul required to support the additional data

demands should be taken seriously. . . .

By January 2011, an AT&T employee was observing that "TMO was first to have HSPA+

devices in their portfolio . . . . we added them in reaction to potential loss of speed claims."

(Ellipsis in original.)

31. After a period of disappointing results, T-Mobile recently brought in new

management and launched plans to revitalize the company by returning to its roots as the

industry value and innovation leader. T-Mobile's executive team articulated its vision of

T-Mobile's future in a November/December 2010 document titled "T-Mobile USA Challenger

Strategy: The Path Forward":

Our heritage and future is as a challenger brand. TMUS will attack incumbents

and find innovative ways to overcome scale disadvantages. TMUS will be faster,

more agile, and scrappy, with diligence on decisions and costs both big and small.

Our approach to market will not be conventional, and we will push to the

boundaries where possible. . . . TMUS will champion the customer and break

down industry barriers with innovations . . . .

32. Consistent with its history, and in a clear threat to larger rivals such as AT&T,

T-Mobile decided to position itself as the carrier to "make smart phones affordable for the

average US consumer." A key component of T-Mobile's new strategy is to offer "Disruptive

Pricing" plans to attract the estimated 150 million consumers whom T-Mobile believes will want

a smartphone but do not yet have one. T-Mobile's CEO Philipp Humm defined as "disruptive" a

rate plan that "Verizon/ATT can't match." T-Mobile has designed its new aggressive pricing

plans to offer services, including data access, at rates lower than those offered by AT&T and

Verizon, and it projects that the new plans will save consumers several hundred dollars per year

as compared to similar AT&T and Verizon plans.

15

33. Relying on its disruptive pricing plans, its improved high-speed HSPA+ network,

and a variety of other initiatives, T-Mobile aimed to grow its nationwide share to 17 percent

within the next several years, and to substantially increase its presence in the enterprise and

government market. AT&T's acquisition of T-Mobile would eliminate the important price,

quality, product variety, and innovation competition that an independent T-Mobile brings to the

marketplace.

2. Competitive Harm: Mobile Wireless Telecommunications Services

34. AT&T and T-Mobile compete locally and nationally against each other, as well as

against Verizon and Sprint, to attract mobile wireless telecommunications services customers,

including in the markets identified in Appendix B. They also compete nationally to attract

enterprise and government customers for mobile wireless telecommunications services.

Competition taking place across a variety of dimensions, including price, plan structure, network

coverage, quality, speeds, devices, and operating systems would be negatively impacted if this

merger were to proceed.

35. The proposed merger would eliminate T-Mobile, one of the four national

competitors, resulting in a significant loss of competition, including in each of the 97 CMAs

identified in Appendix B. In some CMAs, AT&T, T-Mobile, Verizon, and Sprint are the only

competitors with mobile wireless networks. Although in other CMAs there are also one or two

local or regional providers that do serve a significant number of customers, those smaller

providers face significant competitive limitations, largely stemming from their lack of

nationwide spectrum and networks. They are therefore limited in their ability to competitively

constrain the Big Four national carriers. Among other limitations, the local and regional

providers must depend on one of the four nationwide carriers to provide them with wholesale

16

services in the form of "roaming" in order to provide service in the vast majority of the United

States (accounting for most of the U.S. population) that sits outside of their respective service

areas. This places them at a significant cost disadvantage, particularly for the growing number

of customers who use smartphones and exhibit considerable demand for data services. The local

and regional providers also do not have the scale advantages of the four nationwide carriers,

resulting in difficulties obtaining the most popular handsets, among other things. Due in large

part to these limitations and disadvantages, these local and regional providers typically have

small shares and none is as effective a constraint as is T-Mobile on AT&T, Verizon, and Sprint.

Moreover, because each of the four nationwide firms typically offers prices, plans, and devices

on a national basis, the regional and local providers - none of whom has a national share of more

than 3 percent - exert little influence on these aspects of competition. As AT&T noted in

connection with its acquisition of a regional carrier less than three years ago, that carrier's

pricing was "an inconsequential factor in AT&T's competitive decision-making."

36. The substantial increase in concentration that would result from this merger, and

the reduction in the number of nationwide providers from four to three, likely will lead to

lessened competition due to an enhanced risk of anticompetitive coordination. Certain aspects of

mobile wireless telecommunications services markets, including transparent pricing, little buyer-

side market power, and high barriers to entry and expansion, make them particularly conducive

to coordination. Any anticompetitive coordination at a national level would result in higher

nationwide prices (or other nationwide harm) by the remaining national providers, Verizon,

Sprint, and the merged entity. Such harm would affect consumers all across the nation, including

those in rural areas with limited T-Mobile presence. Furthermore, the potential for competitive

harm is heightened given T-Mobile's recent decision to grow its market share via a "challenger"

17

strategy. Its new aggressive and innovative pricing plans, low-priced smartphones, and superior

customer service would have been likely to disrupt current industry models and require

competitive responses from the other national players. Through this proposed merger, AT&T

lessens this threat now, and, if the merger is approved, would eliminate it permanently.

37. The proposed merger likely would lessen competition through elimination of

head-to-head competition between AT&T and T-Mobile. Mobile wireless carriers sell

differentiated services. Among the differentiating characteristics of greatest importance to

consumers are price, network coverage, service quality, customer support, and device options.

Not only do the carriers' offerings differ, but consumers have differing preferences as well.

Because both carriers and consumers are diverse, customers differ as to the firms that are their

closest and most desired alternatives. Where there is significant substitution between the

merging firms by a substantial share of consumers, anticompetitive effects are likely to result.

Documents produced by AT&T and T-Mobile establish that a significant portion of customers

who "churn" from AT&T switch to T-Mobile, and vice versa. This shows a significant degree of

head-to-head competition between the two companies, as demonstrated by T-Mobile's recent

television ads directly targeting AT&T. The proposed merger would, therefore, likely eliminate

important competition between AT&T and T-Mobile.

38. Moreover, tens of millions of Americans have selected T-Mobile as their mobile

wireless carrier because of its unique combination of services, plans, devices, network coverage,

features, and award-winning customer service. By eliminating T-Mobile as an independent

competitor, the proposed transaction likely will reduce innovation and product variety - a serious

concern discussed in Section 6.4 of the Horizontal Merger Guidelines, issued by the U.S.

Department of Justice and the Federal Trade Commission. For example, post-merger, AT&T

18

will no longer offer T-Mobile's lower-priced data and voice plans to new customers or current

customers who upgrade their service. Consequently, T-Mobile as a lower-priced option will be

eliminated from the market, resulting in higher prices for a significant number of consumers.

Furthermore, the innovation that an independent T-Mobile brings to the market - as reflected in

the array of industry "firsts" it has introduced in the past, such as the first Android phone,

Blackberry e-mail, and the Sidekick - would also be lost, depriving consumers of important

benefits.

39. Similarly, competition, including from T-Mobile, has resulted in carriers making

greater investments in technology that lead to better service quality. By eliminating T-Mobile as

an independent competitor, the proposed transaction likely will reduce the competitive incentive

to invest in wireless networks to attract and retain customers.

40. The presence of an independent, competitive T-Mobile, and the competition

between T-Mobile and AT&T, has resulted in lower prices for mobile wireless

telecommunications services across the country than otherwise would have existed. If the

proposed acquisition is consummated, AT&T will eliminate T-Mobile as an independent

competitive constraint. As a result, concentration will increase in many local markets and

competition likely will be substantially lessened across the nation, resulting in higher prices,

diminished investment, and less product variety and innovation than would exist without the

merger, both with respect to services provided over today's mobile wireless devices, as well as

future innovative devices that have yet to be developed.

3. Competitive Harm: Enterprise and Government Mobile Wireless

Telecommunications Services

41. In the national market for mobile wireless telecommunications services provided

to enterprise and government customers, the proposed transaction effectively would reduce the

19

number of significant competitors from four to three. Local and regional providers have an

insignificant presence because enterprise and government customers typically require their

providers to have nationwide networks, and because local and regional carriers generally refrain

from bidding for out-of-network business due to the costs associated with paying roaming rates

for services in locations outside of their network footprints. In many instances, enterprise and

government customers will contract with more than one of the mobile wireless providers to

ensure ubiquitous coverage and provide employees with a choice. In addition, contracting with

multiple national carriers preserves the incentives for each carrier to provide competitive service

enhancements for the duration of their contracts. The reduction in the number of bidders for

enterprise and government contracts to three - and in some cases fewer - significantly increases

the risk of anticompetitive effects.

42. T-Mobile historically has been particularly aggressive on price. AT&T's

acquisition of T-Mobile therefore removes potentially the most attractive bidder from many bid

situations. Accordingly, the merged firm likely will have a reduced incentive to submit low bids.

In addition, the remaining bidders - typically Verizon and/or Sprint - also may bid less

aggressively. For some customers, such as enterprises whose employees travel extensively

internationally, AT&T and T-Mobile are particularly close substitutes.

43. Absent the proposed merger, T-Mobile would likely have an even more important

competitive presence in the enterprise and government market going forward. In the past,

enterprise and government customers were not a primary focus for T-Mobile. As part of its 2011

business plan, however, T-Mobile re-dedicated itself to becoming a bigger player with the stated

goal of growing enterprise revenues substantially by 2013.

20

44. T-Mobile makes its presence felt competing head to head with AT&T and other

carriers for a number of accounts, winning business in some cases and often pushing prices lower

when it does not. The merger's elimination of T-Mobile as an aggressive competitor would

likely result in fewer choices and higher prices for enterprise and government customers.

E. Entry

45. Entry by a new mobile wireless telecommunications services provider in the

relevant geographic markets would be difficult, time-consuming, and expensive, requiring

spectrum licenses and the construction of a network. To replace the competition that would be

lost from AT&T's elimination of T-Mobile as an independent competitor, moreover, a new

entrant would need to have nationwide spectrum, a national network, scale economies that arise

from having tens of millions of customers, and a strong brand, as well as other valued

characteristics. Therefore, entry in response to a small but significant price increase for mobile

wireless telecommunications services would not be likely, timely, and sufficient to thwart the

competitive harm resulting from AT&T's proposed acquisition of T-Mobile, if it were

consummated.

F. Efficiencies

46. The Defendants cannot demonstrate merger-specific, cognizable efficiencies

sufficient to reverse the acquisition's anticompetitive effects.

21

V. VIOLATION ALLEGED

47. The effect of AT&T's proposed acquisition of T-Mobile, if it were to be

consummated, likely will be to lessen competition substantially in interstate trade and commerce

in the relevant geographic markets for mobile wireless telecommunications services, and

enterprise and government mobile wireless telecommunications services, in violation of

Section 7 of the Clayton Act, 15 U.S.C. § 18.

48. Unless enjoined, the transaction likely will have the following effects in mobile

wireless telecommunications services in the relevant geographic markets, among others:

a. actual and potential competition between AT&T and T-Mobile will be

eliminated;

b. competition in general likely will be lessened substantially;

c. prices are likely to be higher than they otherwise would;

d. the quality and quantity of services are likely to be less than they

otherwise would due to reduced incentives to invest in capacity and

technology improvements; and

e. innovation and product variety likely will be reduced.

VI. REQUESTED RELIEF

The Plaintiffs request:

49. That AT&T's proposed acquisition of T-Mobile be adjudged to violate Section 7

of the Clayton Act, 15 U.S.C. § 18;

50. That Defendants be permanently enjoined from and restrained from carrying out

the Stock Purchase Agreement dated March 20, 2011, or from entering into or carrying out any

22

agreement, understanding, or plan, the effect of which would be to bring the telecommunications

businesses of AT&T and T-Mobile under common ownership or control;

51. That Plaintiffs be awarded their costs of this action;

52. That Plaintiff States be awarded their reasonable attorneys' fees; and

53. That Plaintiffs have such other relief as the Court may deem just and proper.

23

Dated this 16th day of September 2011.

Respectfully submitted.

Kenneth M. Dintzer

Matthew C. Hammond

Shobitha Bhat

Katherine A. Celeste

Jillian E. Charles (D.C. Bar #459052)

Robert E. Draba (D.C. Bar #496815)

Stephen T. Fairchild

Lauren J. Fishbein (D.C. Bar #451889)

Kerrie J. Freeborn (D.C. Bar #503143)

Peter A. Gray

F. Patrick Hallagan

Ryan M. Kantor

Robert A. Lepore

Brent E. Marshall

William M. Martin

Kathleen S. O'Neill

Mark Tobey

Frank Y. Qi

Carl Willner (D.C. Bar #412841)

Attorneys

U.S. Department of Justice, Antitrust

Division

Telecommunications & Media

Enforcement Section

450 Fifth Street, N.W., Suite 7000

Washington, DC 20530

Phone: (202) 514-5621

Facsimile: (202) 514-6381

claude.scott@usdoj .gov

* Attorney of Record

FOR PLAINTIFF STATE OF NEW YORK

ERIC T. SCHNEIDERMAN

Attorney General of the State of New York

HARLAN A, LEVY

First Deputy Attorney General

Geralyn J. Trujillo

Mary Ellen Burns

Keith H. Gordon

Matthew D. Siegel

STATE OF NEW YORK

Office of the Attorney General

120 Broadway, 26

th

Floor

New York, NY 10271-0332

Tel: (212) 416-8284

Fax: (212) 416-6015

FOR PLAINTIFF STATE OF WASHINGTON:

ROBERT M. MCKENNA

Attorney General

TINA E. KONDO

Deputy Attorney General

Jonathan A. Mark (WSBA No. 38051)

Antitrust Division

800 Fifth Avenue, S. 2000

Seattle, WA 98104

Tel: (206) 464-7030

Fax: (206) 464-6338

davidk3 @atg.wa.gov

FOR PLAINTIFF STATE OF CALIFORNIA:

KAMALA D. HARRIS

Attorney General of California

MARK BRECKLER

Chief Assistant Attorney General

KATHLEEN FOOTE

Senior Assistant Attorney General

Deputy Attorney General

Office of the Attorney General

Antitrust Section

455 Golden Gate Avenue, Suite 11000

San Francisco, CA 94102

Tel: (415) 703-5518

Fax: (415) 703-5480

Ben Labow (CA SBN 229443)

Deputy Attorney General

Office of the Attorney General

Antitrust Section

300 South Spring Street, Suite 1700

Los Angeles, CA 90013

Tel: (213) 897-2691

Fax: (213) 620-6005

Attorneys for the State of California

FOR PLAINTIFF STATE OF ILLINOIS:

LISA MADIGAN

Attorney General

ROBERT W. PRATT

Chadwick O. Brooker

Office of the Illinois Attorney General

100 W. Randolph Street

Chicago, Illinois 60601

(312) 814-3722

Fax: (312) 814-4209

FOR PLAINTIFF COMMONWEALTH OF MASSACHUSETTS:

MARTHA COAKLEY

Attorney General

William T. Matlack (MA BBO No. 552109)

Chief, Antitrust Division

Michael P. Franck (MA BBO No. 668132, D.C. Bar No. 501023 [inactive])

Assistant Attorney General

Antitrust Division

One Ashburton Place

Boston, MA 02108

Tel: (617) 727-2200

Fax: (617) 722-0184

R. MICHAEL DEWINE

Attorney General

JENNIFER L. PRATT

Assistant Attorney General

Chief, Antitrust Section

Antitrust Division

150 E. Gay St.-23

rd

Floor

Columbus, OH 43215

Tel: (614) 466-4328

Fax: (614) 995-0269

Attorneys for the State of Ohio

FOR PLAINTIFF COMMONWEALTH OF PENNSYLVANIA

LINDA L. KELLY

Attorney General

Deputy Attorney General

Office of Attorney General

Antitrust Section

14

th

Floor, Strawberry Square

Harrisburg, PA 17120

Tel: (717) 787-4530

Fax: (717) 787-1190

Attorneys for the Commonwealth of

Pennsylvania

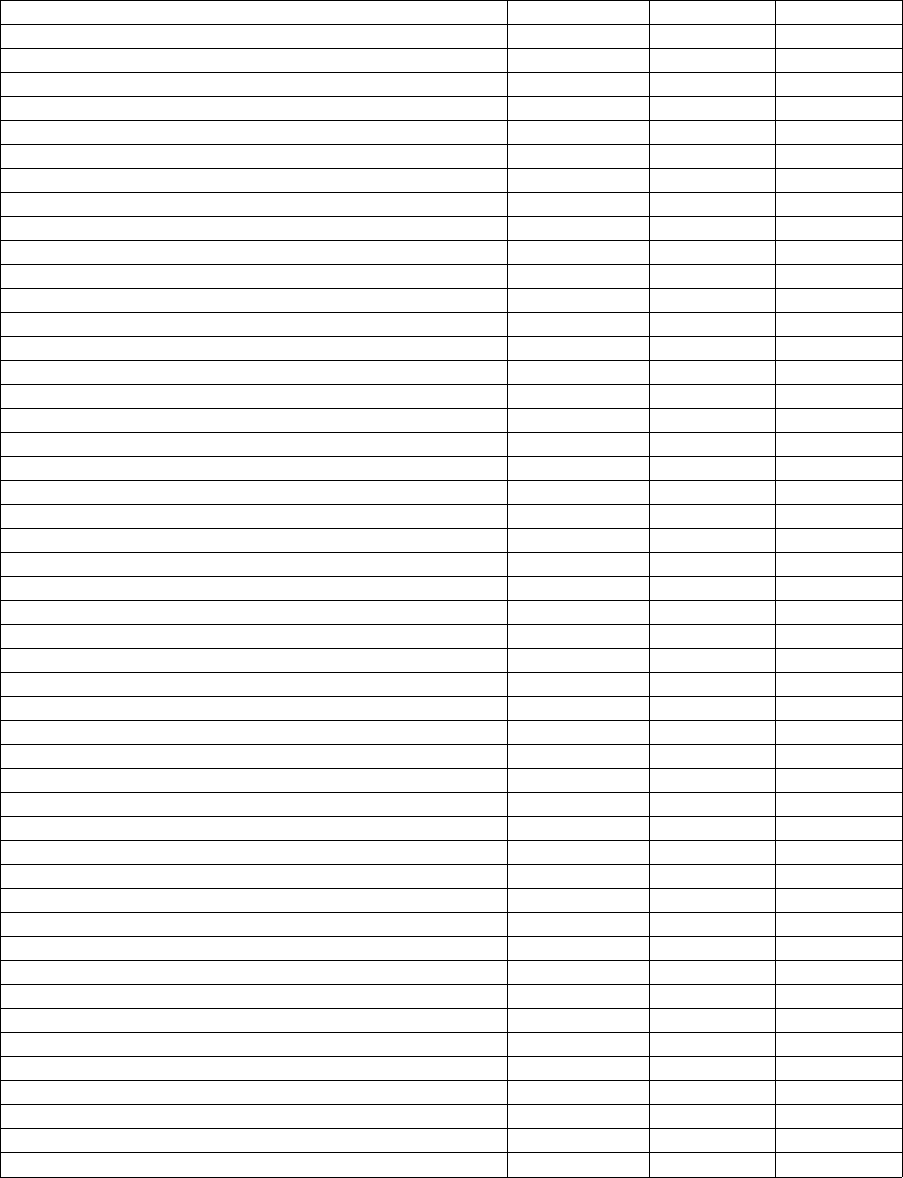

APPENDIX A

Herfindahl-Hirschman Index

The term "HHI" means the Herfindahl-Hirschman Index, a commonly accepted measure

of market concentration. The HHI is calculated by squaring the market share of each firm

competing in the market and then summing the resulting numbers. For example, for a market

consisting of four firms with shares of 30, 30, 20, and 20 percent, the HHI is 2,600 (30

2

+ 30

2

+

2 2

20 + 20 = 2,600). The HHI takes into account the relative size distribution of the firms in a

market. It approaches zero when a market is occupied by a large number of firms of relatively

equal size and reaches its maximum of 10,000 points when a market is controlled by a single

firm. The HHI increases both as the number of firms in the market decreases and as the disparity

in size between those firms increases.

Markets in which the HHI is between 1,500 and 2,500 points are considered to be

moderately concentrated, and markets in which the HHI is in excess of 2,500 points are

considered to be highly concentrated. See Horizontal Merger Guidelines § 5.3 (issued by the

U.S. Department of Justice and the Federal Trade Commission on Aug. 19, 2010). Transactions

that increase the HHI by more than 200 points in highly concentrated markets will be presumed

to be likely to enhance market power. Id. Mergers resulting in highly concentrated markets that

involve an increase in the HHI of between 100 points and 200 points potentially raise significant

competitive concerns and often warrant scrutiny. Id.

i

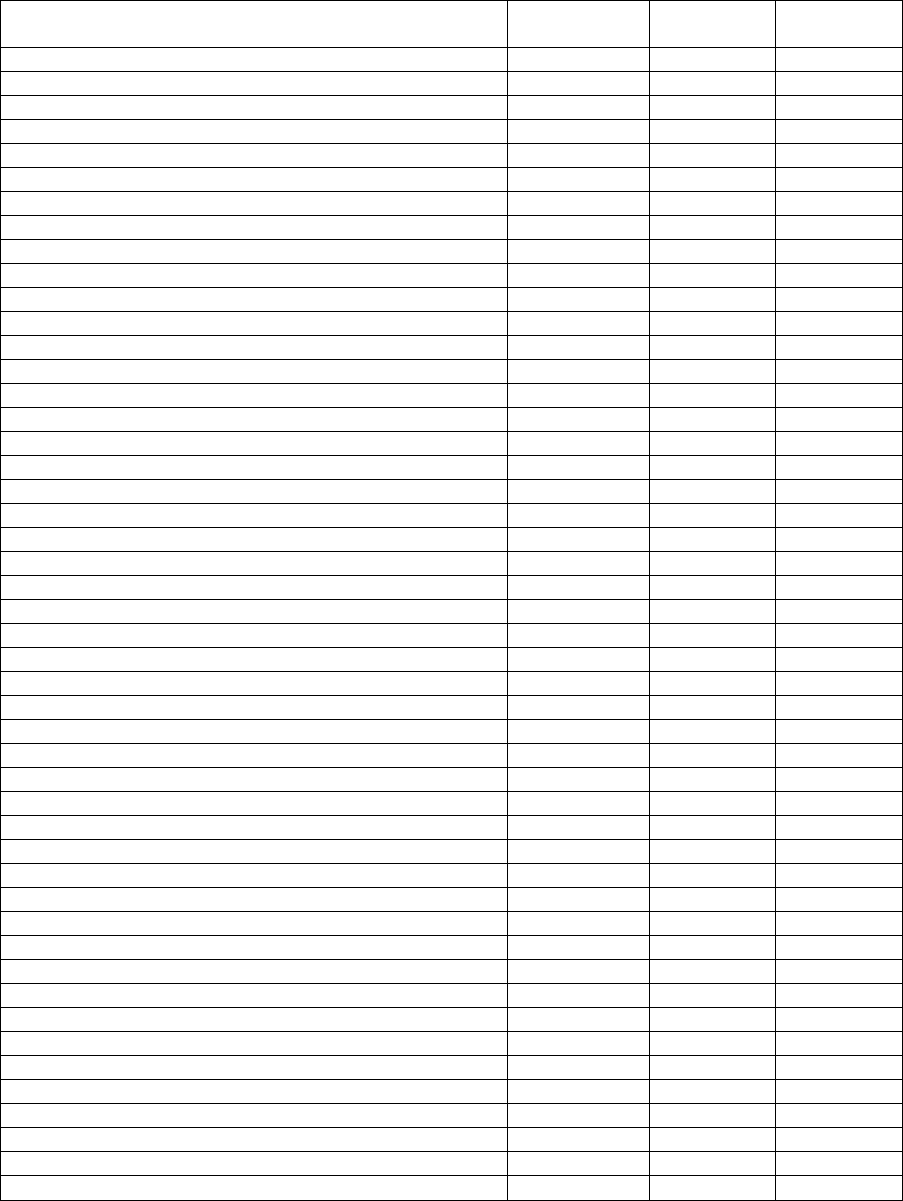

APPENDIX B

Relevant Geographic Market CMAs

CMA Number and Name

Post-merge

r

share

HHI Post-

Merger

Increase in

HHI

001-New York, NY-NJ

43.7% 3335 951

002-Los Angeles-Long Beach, CA

41.4% 3174 794

003-Chicago, IL

48.1% 3189 1114

004-Philadelphia, PA 45.2% 3385 918

005-Detroit/Ann Arbor, MI 31.9% 2857 420

006-Boston-Lowell-Brockton-Lawrence-Haverhill, MA-NH 40.9% 3495 731

007-San Francisco-Oakland, CA 50.3% 3438 763

008-Washington, DC-MD-VA 39.6% 3282 636

009-Dallas-Fort Worth, TX

58.0% 3980 1267

010-Houston, TX 52.1% 3578 1350

011-St. Louis, MO-IL

46.7% 3269 739

012-Miami-Fort Lauderdale-Hollywood, FL

48.1% 3341 1027

013-Pittsburgh, PA 31.8% 3650 347

014-Baltimore, MD

36.5% 3294 570

015 -Minneapolis-St. Paul, MN-WI 45.5% 3596 1033

016-Cleveland, OH

29.7% 3717 365

017-Atlanta, GA

46.6% 3223 886

018-San Diego, CA 40.8% 3248 711

019-Denver-Boulder, CO 41.9% 3227 857

020-Seattle-Everett, WA

53.2% 4044 1376

021-Milwaukee, WI

34.3% 2493 394

022-Tampa-St. Petersburg, FL

39.1% 2935 741

023-Cincinnati, OH-KY-IN

22.6% 2575 215

024-Kansas City, MO-KS

44.0% 3329 948

025-Buffalo, NY

31.6% 3385 362

026-Phoenix, AZ 32.9% 3178 536

027-San Jose, CA 48.6% 3466 675

028-Indianapolis, IN

41.5% 3314 515

029-New Orleans, LA

43.9% 3579 607

030-Portland, OR-WA

47.2% 3629 963

031-Columbus, OH

30.7% 3412 407

032-Hartford-New Britain-Bristol, CT 41.0% 3657 538

033-San Antonio, TX

43.4% 3117 761

034-Rochester, NY 26.5% 4330 228

035-Sacramento, CA

46.2% 3238 697

036-Memphis, TN-AR-MS

49.6% 3136 892

037-Louisville, KY-IN

48.0% 3365 864

038-Providence-Warwick-Pawtucket, RI

42.7% 3509 902

039-Salt Lake City-Ogden, UT

49.6% 3653 1230

040-Dayton, OH 29.2% 2814 298

041-Birmingham, AL 57.8% 4181 1332

042-Bridgeport-Stamford-Norwalk-Danbury, CT 40.3% 3582 602

043 -Norfolk-Virginia Beach-Portsmouth, VA/NC 28.3% 3103 384

044-Albany-Schenectady-Troy, NY

30.8% 3607 205

045-Oklahoma City, OK

63.2% 4399 1335

046-Nashville -Davidson, TN 31.8% 3164 347

047-Greensboro-Winston-Salem-High Point, NC 28.2% 3358 250

048-Toledo, OH-MI

17.4% 3822 127

ii

049-New Haven-West Haven-Waterbury-Meriden, CT

47.4% 3671 770

050-Honolulu, HI

55.5% 3821 1531

051-Jacksonville, FL

50.1% 3482 1084

052-Akron, OH 30.1% 3849 354

053-Syracuse, NY

35.9% 3905 227

054-Gary-Hammond-East Chicago, IN

40.3% 3121 739

055 -Worchester-Fitchburg-Leominster, MA 38.7% 3968 419

056-Northeast Pennsylvania, PA

42.6% 3935 414

057-Tulsa, OK

57.6% 3827 768

058-Allentown-Bethlehem-Easton, PA-NJ 52.1% 4060 1052

059-Richmond, VA

24.6% 3472 267

060-Orlando, FL

49.3% 3390 1086

061 -Charlotte-Gastonia, NC 31.4% 3133 331

062-New Brunswick-Perth Amboy-Sayreville, NJ

37.0% 3753 635

063-Springfield-Chicopee-Holyoke, MA

43.1% 3896 840

064-Grand Rapids, MI

24.5% 3370 174

066-Youngstown-Warren, OH 44.8% 3438 639

067-Greenville-Spartanburg, SC 30.3% 4124 381

068-Flint, MI

25.7% 3168 163

069-Wilmington, DE-NJ-MD 37.3% 3426 469

070-Long Branch-Asbury Park, NJ 28.9% 4427 326

071 -Raleigh-Durham, NC 32.0% 3236 279

072-West Palm Beach-Boca Raton, FL

49.7% 3317 788

073 -Oxnard-Simi Valley-Ventura, CA 41.9% 3618 500

074-Fresno, CA

53.6% 3680 885

075-Austin, TX 54.4% 3867 1157

076-New Bedford-Fall River, MA

38.4% 3479 582

077-Tucson, AZ 29.7% 3394 431

078-Lansing-East Lansing, MI

21.5% 3689 155

079-Knoxville, TN

27.0% 2812 123

080-Baton Rouge, LA 65.0% 4838 611

081 -El Paso, TX 40.9% 2877 751

082-Tacoma, WA

41.8% 3683 866

083-Mobile, AL

57.8% 4048 1177

084-Harrisburg, PA 47.2% 3973 576

085-Johnson City-Kingsport-Bristol, TN-VA 24.7% 4323 241

086-Albuquerque, NM

33.4% 3400 541

087-Canton, OH 27.5% 4242 267

088-Chattanooga, TN-GA

27.6% 3799 262

089-Wichita, KS

40.5% 3081 765

090-Charleston-North Charleston, SC 36.2% 3483 654

091-San Juan-Caguas, PR 54.3% 4022 1134

092-Little Rock-North Little Rock, AR

53.9% 3867 276

093-Las Vegas, NV

45.6% 3076 958

095-Columbia, SC

31.4% 3887 408

096-Fort Wayne, IN

34.0% 3824 314

097-Bakersfield, CA

51.7% 3643 795

099-York, PA 48.6% 3922 656

100-Shreveport, LA

48.9% 3618 197

iii